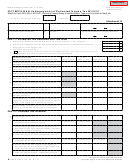

2013 MI-1040H, Page 2

Instructions for Form MI-1040H, Schedule of Apportionment

Business income from business activity that is taxable both

Sales of tangible personal property are in Michigan if:

within and outside Michigan is apportioned to Michigan using

1.

The property is shipped or delivered to a purchaser (other

this form. If you have more than one MI-1040H Schedule of

than the United States government) within Michigan

Apportionment, total losses attributable to other states should

regardless of the free on board (F.O.B.) point or other

be reported on line 4 of the Michigan Schedule 1. Total income

conditions of the sale, or

attributable to other states should be reported on line 13 of the

2. The property is shipped from an office, store, warehouse,

Michigan Schedule 1. The Michigan income tax statute uses

factory or other place of storage in Michigan and the

the standards prescribed by federal Public Law (P.L.) 86-272

purchaser is the United States government or the taxpayer

to determine if a taxpayer’s income is taxable in another state.

is not taxable in the state of the purchaser.

A taxpayer’s income is taxable in another state if:

Sales (other than of tangible personal property) are in Michigan

1. In that state the taxpayer is subject to a net income tax, a

if:

franchise tax measured by net income, a franchise tax for

1. The business activity is performed in Michigan, or

the privilege of doing business, a corporate stock tax, or

2. The business activity is performed both in Michigan and

2. That state has jurisdiction to subject the taxpayer to a net

in another state(s), but based on cost of performance, a

income tax regardless of whether the state does or does not.

greater proportion of the business activity is performed in

Sales Factor

Michigan.

There are special formulas for transportation companies and

Divide the total sales in Michigan during the tax year by the

other authorized taxpayers. Those formulas are identified in

total sales everywhere during the tax year.

Chapter 3 of the Michigan’s Income Tax Act.

“Sales” includes gross receipts from sales of tangible property,

rental of property and providing of services that constitute

business activity. Exclude all receipts of nonbusiness income.

Note: Throwback sales for individual income tax follow

federal P.L. 86-272 standards. The business must have physical

presence in the other state or activity beyond solicitation of

sales in order to exclude sales into another state or country

from the numerator. The Michigan income tax act definition of

“state” includes a foreign country. Therefore, foreign sales are

considered Michigan sales unless the business entity is taxable

in the foreign country.

1

1 2

2