A

D

R

This space for office use.

LABAMA

EPARTMENT OF

EVENUE

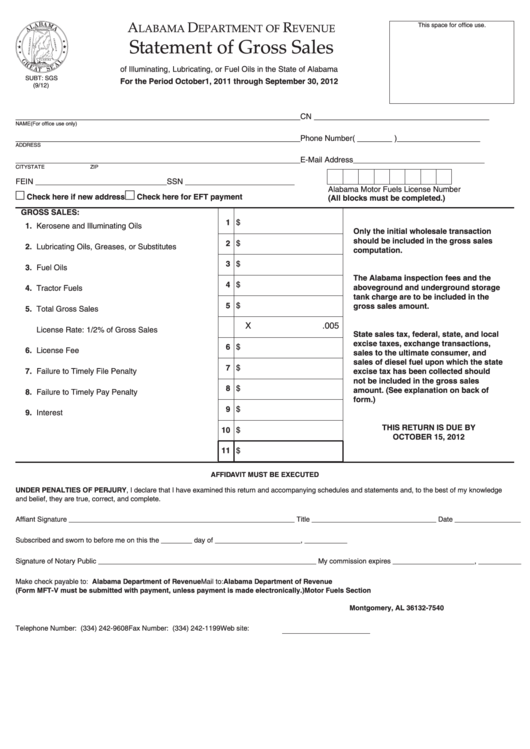

Statement of Gross Sales

RESET

of Illuminating, Lubricating, or Fuel Oils in the State of Alabama

SUBT: SGS

For the Period October 1, 2011 through September 30, 2012

(9/12)

_________________________________________________________________

CN ________________________________________

NAME

(For office use only)

_________________________________________________________________

Phone Number ( ________ ) ___________________

ADDRESS

_________________________________________________________________

E-Mail Address ______________________________

CITY

STATE

ZIP

FEIN ______________________________ SSN _________________________

Alabama Motor Fuels License Number

Check here if new address

Check here for EFT payment

(All blocks must be completed.)

GROSS SALES:

1

$

1. Kerosene and Illuminating Oils . . . . . . . . . . . . . . . . . .

Only the initial wholesale transaction

should be included in the gross sales

2

$

2. Lubricating Oils, Greases, or Substitutes . . . . . . . . .

computation.

3

$

3. Fuel Oils . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

The Alabama inspection fees and the

4

$

aboveground and underground storage

4. Tractor Fuels . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

tank charge are to be included in the

5

$

gross sales amount.

5. Total Gross Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

X

.005

License Rate: 1/2% of Gross Sales . . . . . . . . . . . . . .

State sales tax, federal, state, and local

excise taxes, exchange transactions,

6

$

6. License Fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

sales to the ultimate consumer, and

sales of diesel fuel upon which the state

7

$

7. Failure to Timely File Penalty . . . . . . . . . . . . . . . . . . .

excise tax has been collected should

not be included in the gross sales

8

$

amount. (See explanation on back of

8. Failure to Timely Pay Penalty . . . . . . . . . . . . . . . . . . .

form.)

9

$

9. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

THIS RETURN IS DUE BY

10

$

10. Total Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

OCTOBER 15, 2012

11

$

11. Amount Remitted . . . . . . . . . . . . . . . . . . . . . . . . . . . .

AFFIDAVIT MUST BE EXECUTED

UNDER PENALTIES OF PERJURY, I declare that I have examined this return and accompanying schedules and statements and, to the best of my knowledge

and belief, they are true, correct, and complete.

Affiant Signature __________________________________________________________ Title ________________________________ Date _________________

Subscribed and sworn to before me on this the ________ day of ______________________, ___________

Signature of Notary Public ________________________________________________________ My commission expires _____________________, ___________

Make check payable to: Alabama Department of Revenue

Mail to: Alabama Department of Revenue

(Form MFT-V must be submitted with payment, unless payment is made electronically.)

Motor Fuels Section

P.O. Box 327540

Montgomery, AL 36132-7540

Telephone Number: (334) 242-9608

Fax Number: (334) 242-1199

Web site:

1

1 2

2