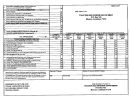

Statement of Gross Sales

The tax is computed at a rate of 1/2 of 1% of the wholesaler’s gross sales of illuminating, lubricating, and fuel oils for

the preceding fiscal year. You are required to file this return by October 15, 2012 whether or not any tax is due.

Instructions for completing the return:

Line 1 – Enter the gross sales of kerosene and illuminating oils.

Line 2 – Enter the gross sales of lubricating oils, greases, transmission fluid, and substitutes.

Line 3 – Enter the gross sales of fuel oils (tax-free diesel fuel, heating oil, burner oil, and Bunker “C”).

Line 4 – Enter the gross sales of tractor fuels.

Line 5 – Enter the total of lines 1 through 4.

Line 6 – Enter the result of multiplying the amount entered on line 5 by .005.

Line 7 – If the return is delinquent, enter $50.00 or the result of multiplying line 6 by 10%, whichever is greater.

Line 8 – If payment is not timely remitted, determine the number of months or fraction thereof that the return has

been delinquent. Multiply that number by 1% to determine the percentage for the failure to timely pay

penalty (not to exceed 25%). Enter the result of multiplying line 6 by the percentage for the failure to timely

pay penalty.

Line 9 – If the return is delinquent, enter the result of multiplying line 6 by the applicable interest rate. Contact this

office for the interest rate.

Line 10 – Enter the total of lines 6 through 9.

Line 11 – Enter the amount remitted.

Explanation Regarding Diesel Fuel Sales

Undyed diesel fuel should be excluded from the gross sales computation under the following circumstances:

1. Undyed diesel fuel is sold tax-paid and you remit the motor fuel excise tax to the State of Alabama.

or

2. Undyed diesel fuel is sold tax-free to a licensed distributor for whom you are the “sole” supplier. This

licensed distributor must remit the motor fuel excise tax to the State of Alabama and list you as the only

supplier on the motor fuel excise tax returns. If so, you are responsible for obtaining and keeping copies

of that customer’s monthly State of Alabama motor fuel excise tax returns in your files.

1

1 2

2