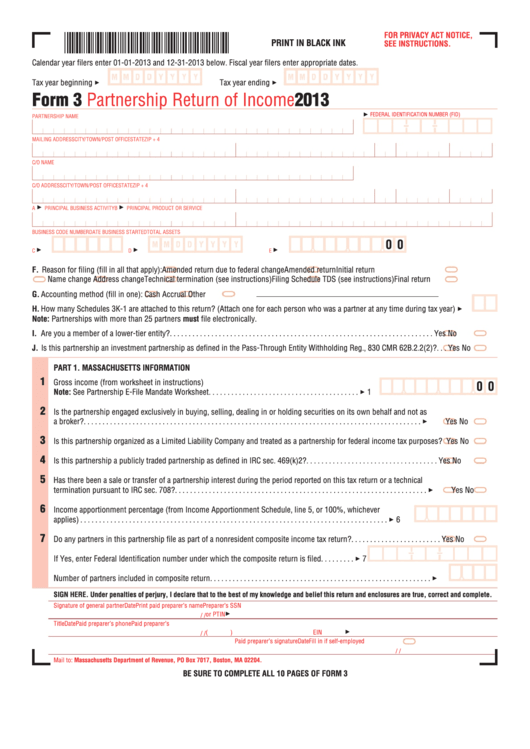

File pg. 1

FOR PRIVACY ACT NOTICE,

PRINT IN BL CK INK

SEE INSTRUCTIONS.

Calendar year filers enter 01-01-2013 and 12-31-2013 below. Fiscal year filers enter appropriate dates.

Tax year beginning

Tax year ending

Form 3

Partnership Return of Income

2013

FEDERAL IDENTIFICATION NUMBER (FID)

PARTNERSHIP NAME

MAILING ADDRESS

CITY/TOWN/POST OFFICE

STATE

ZIP + 4

C/O NAME

C/O ADDRESS

CITY/TOWN/POST OFFICE

STATE

ZIP + 4

A

PRINCIPAL BUSINESS ACTIVITY

B

PRINCIPAL PRODUCT OR SERVICE

BUSINESS CODE NUMBER

DATE BUSINESS STARTED

TOTAL ASSETS

0 0

C

D

E

F. Reason for filing (fill in all that apply):

Amended return due to federal change

Amended return

Initial return

Name change

Address change

Technical termination (see instructions)

Filing Schedule TDS (see instructions)

Final return

G. Accounting method (fill in one):

Cash

Accrual

Other

H. How many Schedules 3K-1 are attached to this return? (Attach one for each person who was a partner at any time during tax year)

Note: Partnerships with more than 25 partners must file electronically.

I. Are you a member of a lower-tier entity? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

J. Is this partnership an investment partnership as defined in the Pass-Through Entity Withholding Reg., 830 CMR 62B.2.2(2)? . . .

Yes

No

PART 1. MASSACHUSETTS INFORMATION

1

Gross income (from worksheet in instructions)

0 0

Note: See Partnership E-File Mandate Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Is the partnership engaged exclusively in buying, selling, dealing in or holding securities on its own behalf and not as

a broker? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

3

Is this partnership organized as a Limited Liability Company and treated as a partnership for federal income tax purposes?

Yes

No

4

Is this partnership a publicly traded partnership as defined in IRC sec. 469(k)2? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

5

Has there been a sale or transfer of a partnership interest during the period reported on this tax return or a technical

termination pursuant to IRC sec. 708? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

6

Income apportionment percentage (from Income Apportionment Schedule, line 5, or 100%, whichever

applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Do any partners in this partnership file as part of a nonresident composite income tax return? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If Yes, enter Federal Identification number under which the composite return is filed . . . . . . . . .

7

Number of partners included in composite return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature of general partner

Date

Print paid preparer’s name

Preparer’s SSN

or PTIN

/

/

Title

Date

Paid preparer’s phone

Paid preparer’s

(

)

EIN

/

/

Paid preparer’s signature

Date

Fill in if self-employed

/

/

Mail to: Massachusetts Department of Revenue, PO Box 7017, Boston, MA 02204.

BE SURE TO COMPLETE ALL 10 PAGES OF FORM 3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10