File pg. 7

2013 FORM 3, PAGE 7

From U.S. Form 1065, Schedule B.

Other Information.

31. Type of entity filing this return (check one):

Domestic general partnership

Domestic limited partnership

Domestic limited liability company

Domestic limited liability partnership

Foreign partnership

REIT

Other (specify)

32. At any time during the tax year, was any partner in the partnership a disregarded entity, a partnership (including an entity treated as

a partnership), a trust, an S corporation, an estate (other than an estate of a deceased partner) or a nominee or similar person?:

Yes

No

33. Is this partnership a publicly traded partnership as defined in Section 469(k)(2)?:

Yes

No

34. During the tax year, did the partnership have any debt that was cancelled, was forgiven, or had the terms modified so as to reduce

the principal amount of the debt?:

Yes

No

35. Is the partnership making, or had previously made (and not revoked), a Section 754 election? (See instructions for details regarding

a Section 754 election.):

Yes

No

36. Did the partnership make for this tax year an optional basis adjustment under Section 743(b) or 734(b)?:

Yes

No

If Yes, attach a statement showing the computation and allocation of the basis adjustment. See instructions.

37. During the current or prior tax year, did the partnership engage in a like-kind exchange or distribute any property received in a

like-kind exchange, or contribute such property to another entity (other than entities wholly-owned by the partnership throughout

the tax year)?:

Yes

No

From U.S. Form 1065, Schedule K.

Partners’ Distributive Share Items.

Income or Loss

38. Ordinary business income or loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

39. Net rental real estate income or loss (from U.S. Form 8825) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

40a. Other gross rental income or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40a

b. Expenses from other rental activities (attach statement). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40b

c. Other net rental income or loss. Subtract line 40b from line 40a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40c

41. Guaranteed payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42. Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

43a. Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43a

b. Qualified dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43b

44. Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

45. Net short-term capital gain or loss (from U.S. Form 1065, Schedule D). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

46a. Net long-term capital gain or loss (from U.S. Form 1065, Schedule D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46a

b. Collectibles (28%) gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46b

c. Unrecaptured Section 1250 gain (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46c

47. Net Section 1231 gain or loss (from U.S. Form 4797). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

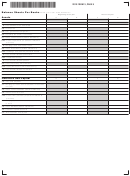

48. Other income or loss (see instructions). Type

48

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10