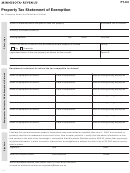

Property Tax Statement of Exemption

Instructions

Questions?

•

A description of the business of

the applicant and an explanation of

In accord with Minnesota Statutes

If you need help completing this appli-

how the property is utilized.

section 272.02, an applicant requesting

cation, call (651) 556-6091.

exemption of all or a portion of any real

TTY: Call 711 for Minnesota Relay.

•

Name of equipment or device as

property or equipment or device, or

shown on the application form.

Email

part thereof, operated primarily for the

sa.property@state.mn.us

•

Date of the Property Tax Exemp-

control or abatement or air, water, or

tion Application for Property Used

Address

land pollution must first file the Form

for Pollution Control.

Minnesota Revenue

PT-63, Property Tax Exemption Applica-

Mail Station 3340

tion for Property Used for Pollution Con-

•

Date of the Order Exempting Prop-

St. Paul, MN 55156-3340

trol. Once this application is approved

erty Used For Pollution Control Or

the commissioner will issue an order

Housing Pollution Control Devices.

Forms

exempting the property.

Forms and other tax information are

Use of Information

available on our website at

In accord with Minnesota Statutes

You are not required by law to pro-

enue.state.mn.us.

section 272.025, subdivision 1(b), a

vide this information. However if you

taxpayer claiming exemption from

We’ll provide this information in other

want to claim exemption for pollution

taxation for personal property used for

formats upon request to persons with

control equipment or devices you must

pollution control must file a Statement

disabilities.

provide all of the requested informa-

of Exemption with the commissioner

tion.

of revenue on or before February 15

of each year for which the taxpayer

Failure to timely file the Statement of

claims an exemption. This form is the

Exemption will result in the commis-

Statement of Exemption Form (Form

sioner rescinding the order granting

PT-64).

exemption.

The following information must be

All information provided on this form

provided:

is public.

•

Name and address of the owner of

File Electronically

the property as shown on the ap-

plication form.

You may submit this completed applica-

tion electronically at sa.property@state.

•

Location, legal description, and

mn.us. Be sure to include all supporting

parcel ID of the land on which the

materials.

property is located as shown on the

application form.

1

1 2

2