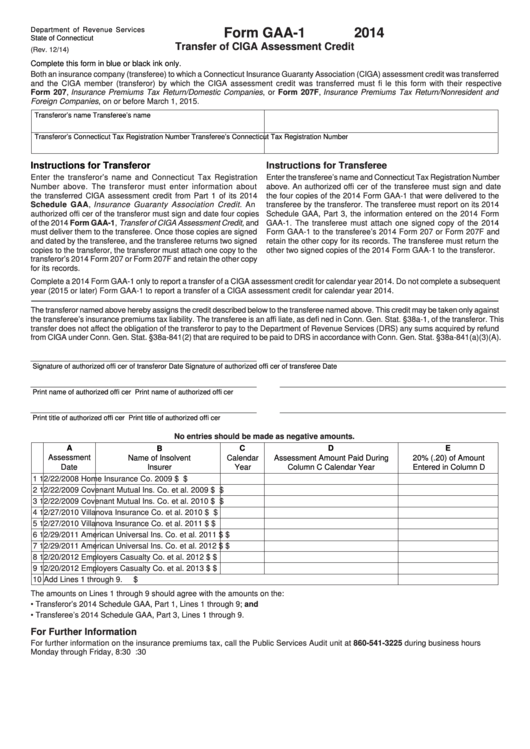

Form Gaa-1 - Transfer Of Ciga Assessment Credit - 2014

ADVERTISEMENT

Department of Revenue Services

Form GAA-1

2014

State of Connecticut

Transfer of CIGA Assessment Credit

(Rev. 12/14)

Complete this form in blue or black ink only.

Both an insurance company (transferee) to which a Connecticut Insurance Guaranty Association (CIGA) assessment credit was transferred

and the CIGA member (transferor) by which the CIGA assessment credit was transferred must fi le this form with their respective

Form 207, Insurance Premiums Tax Return/Domestic Companies, or Form 207F, Insurance Premiums Tax Return/Nonresident and

Foreign Companies, on or before March 1, 2015.

Transferor’s name

Transferee’s name

Transferor’s Connecticut Tax Registration Number

Transferee’s Connecticut Tax Registration Number

Instructions for Transferor

Instructions for Transferee

Enter the transferor’s name and Connecticut Tax Registration

Enter the transferee’s name and Connecticut Tax Registration Number

Number above. The transferor must enter information about

above. An authorized offi cer of the transferee must sign and date

the transferred CIGA assessment credit from Part 1 of its 2014

the four copies of the 2014 Form GAA-1 that were delivered to the

Schedule GAA, Insurance Guaranty Association Credit. An

transferee by the transferor. The transferee must report on its 2014

authorized offi cer of the transferor must sign and date four copies

Schedule GAA, Part 3, the information entered on the 2014 Form

of the 2014 Form GAA-1, Transfer of CIGA Assessment Credit, and

GAA-1. The transferee must attach one signed copy of the 2014

must deliver them to the transferee. Once those copies are signed

Form GAA-1 to the transferee’s 2014 Form 207 or Form 207F and

and dated by the transferee, and the transferee returns two signed

retain the other copy for its records. The transferee must return the

copies to the transferor, the transferor must attach one copy to the

other two signed copies of the 2014 Form GAA-1 to the transferor.

transferor’s 2014 Form 207 or Form 207F and retain the other copy

for its records.

Complete a 2014 Form GAA-1 only to report a transfer of a CIGA assessment credit for calendar year 2014. Do not complete a subsequent

year (2015 or later) Form GAA-1 to report a transfer of a CIGA assessment credit for calendar year 2014.

The transferor named above hereby assigns the credit described below to the transferee named above. This credit may be taken only against

the transferee’s insurance premiums tax liability. The transferee is an affi liate, as defi ned in Conn. Gen. Stat. §38a-1, of the transferor. This

transfer does not affect the obligation of the transferor to pay to the Department of Revenue Services (DRS) any sums acquired by refund

from CIGA under Conn. Gen. Stat. §38a-841(2) that are required to be paid to DRS in accordance with Conn. Gen. Stat. §38a-841(a)(3)(A).

__________________________________________________________

__________________________________________________________

Signature of authorized offi cer of transferor

Date

Signature of authorized offi cer of transferee

Date

__________________________________________________________

__________________________________________________________

Print name of authorized offi cer

Print name of authorized offi cer

__________________________________________________________

__________________________________________________________

Print title of authorized offi cer

Print title of authorized offi cer

No entries should be made as negative amounts.

A

B

C

D

E

Assessment

Name of Insolvent

Calendar

Assessment Amount Paid During

20% (.20) of Amount

Date

Year

Column C Calendar Year

Entered in Column D

Insurer

1

12/22/2008

Home Insurance Co.

2009

$

$

2

12/22/2009

Covenant Mutual Ins. Co. et al.

2009

$

$

3

12/22/2009

Covenant Mutual Ins. Co. et al.

2010

$

$

4

12/27/2010

Villanova Insurance Co. et al.

2010

$

$

5

12/27/2010

Villanova Insurance Co. et al.

2011

$

$

6

12/29/2011

American Universal Ins. Co. et al.

2011

$

$

7

12/29/2011

American Universal Ins. Co. et al.

2012

$

$

8

12/20/2012

Employers Casualty Co. et al.

2012

$

$

9

12/20/2012

Employers Casualty Co. et al.

2013

$

$

10

Add Lines 1 through 9.

$

The amounts on Lines 1 through 9 should agree with the amounts on the:

•

Transferor’s 2014 Schedule GAA, Part 1, Lines 1 through 9; and

•

Transferee’s 2014 Schedule GAA, Part 3, Lines 1 through 9.

For Further Information

For further information on the insurance premiums tax, call the Public Services Audit unit at 860-541-3225 during business hours

Monday through Friday, 8:30 a.m. to 4:30 p.m.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1