Reset Form

Form 2, Page 10 – 2012

Social Security Number:

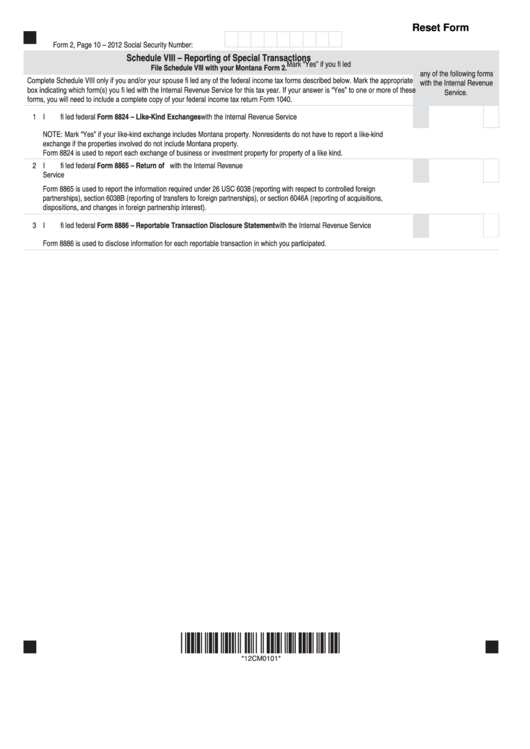

Schedule VIII – Reporting of Special Transactions

Mark “Yes” if you fi led

File Schedule VIII with your Montana Form 2.

any of the following forms

Complete Schedule VIII only if you and/or your spouse fi led any of the federal income tax forms described below. Mark the appropriate

with the Internal Revenue

box indicating which form(s) you fi led with the Internal Revenue Service for this tax year. If your answer is “Yes” to one or more of these

Service.

forms, you will need to include a complete copy of your federal income tax return Form 1040.

1 I fi led federal Form 8824 – Like-Kind Exchanges with the Internal Revenue Service .......................................................................

1

Yes

NOTE: Mark “Yes” if your like-kind exchange includes Montana property. Nonresidents do not have to report a like-kind

exchange if the properties involved do not include Montana property.

Form 8824 is used to report each exchange of business or investment property for property of a like kind.

2 I fi led federal Form 8865 – Return of U.S. Persons With Respect to Certain Foreign Partnerships with the Internal Revenue

Service ..................................................................................................................................................................................................

2

Yes

Form 8865 is used to report the information required under 26 USC 6038 (reporting with respect to controlled foreign

partnerships), section 6038B (reporting of transfers to foreign partnerships), or section 6046A (reporting of acquisitions,

dispositions, and changes in foreign partnership interest).

3 I fi led federal Form 8886 – Reportable Transaction Disclosure Statement with the Internal Revenue Service .............................

3

Yes

Form 8886 is used to disclose information for each reportable transaction in which you participated.

*12CM0101*

*12CM0101*

1

1