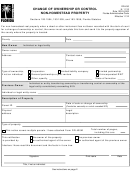

DR-430

INSTRUCTIONS

N. 11/12

Change of Ownership or Control, Non-homestead Property

Page 2

Who should complete this form?

An owner of non-homestead property that has changed ownership or control after January 1 when the

property was last assessed at just value must notify the property appraiser of the change unless a deed or

other document of the change was recorded with the clerk of the court.

A change of ownership or control means:

A sale or foreclosure,

A transfer of legal title or beneficial title in equity to any person, or

A cumulative transfer of control, or of ownership of more than 50%, of the legal entity that owned

the property when it was last assessed at just value.

Send the completed form to the property appraiser in the county where the parcel is located. If one owner

completes and sends a Form DR-430 to the property appraiser, another owner is not required to send an

additional Form DR-430.

You do not need to complete Form DR-430 if:

A deed or other instrument documenting a change of ownership of the property has been

recorded with the county clerk of court.

The transfer corrects an error.

The transfer is between legal and equitable title.

The transfer is between husband and wife, including a transfer to a surviving spouse or on

dissolution of marriage, and the property is non-homestead, residential property under section

193.1554(1), F.S. This does not apply to non-residential property.

For a publicly traded company, the transfer occurred through the buying and selling of shares on

a public exchange. This does not apply to a merger or acquisition by another company.

What if I have more than one parcel that has changed ownership or control?

You can submit Form DR-430M as an attachment to this form to report multiple parcels. Be sure to

identify each page with the name of the owner and date from page one of Form DR-430. Send a copy of

the completed forms to the property appraiser of each county where you have listed a parcel. Form DR-

430M is posted on the Department of Revenue's website at

Reference: Rule 12D-8.00659, Florida Administrative Code

Interest and Penalties

Owners who receive an assessment to which they are not entitled are subject to:

Any taxes avoided plus 15% interest each year, and

A penalty of 50% of the taxes avoided.

The property appraiser is required to record a tax lien on any property owned by a person or entity that

was granted, but not entitled to, the property assessment limitation under s.193.1554 or s.193.1555, F.S.

Contact information and mailing addresses for all Florida property appraisers are on Revenue's web site at:

1

1 2

2