Form M-433-Ois - Statement Of Financial Condition And Other Information Page 7

ADVERTISEMENT

Page 7

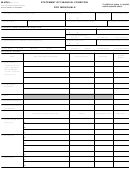

22. Other information. You must answer all of the following questions related to your financial condition. Use additional pages if necessary.

a. Are there any garnishments against your wages?

Yes

No

Name of creditor

Date of judgment

Debt amount

b. Are there any judgments against you?

Yes

No

Name of creditor

Date of judgment

Debt amount

c. Are you a party in a lawsuit?

Yes

No

Amount of suit

Possible completion date

Subject matter of suit

d. Have you ever filed for bankruptcy?

Yes

No

Date filed

Date discharged

Docket number

e. In the past ten years have you transferred any assets out of your name for less than their actual value?

Yes

No

Type of asset

Value at time of transfer

Consideration received

f. Do you anticipate any increase in household income in the next two years?

Yes

No

Reason for income increase

g. Are you the beneficiary of an estate or trust?

Yes

No

Name of trust or estate

Amount to be received

Date to be received

h. Are you the grantor or donor of any trust or the trustee or fiduciary for any trust

Yes

No

Name of trust

Present value of assets of trust

i. Are you a participant in a profit sharing plan?

Yes

No

Name of plan

Value in plan

j. Do you currently hold any state licenses or contracts?

Yes

No

Type of license

License number

Declaration and Signature of Applicant

Failure to disclose all information requested in this form may result in the rejection of your offer and prohibit you from having any future offer accepted.

Under the pains and penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets, liabilities and other information is

true, correct and complete.

Your signature

Date

Spouse’s signature (if applicable)

Date

Declaration and Signature of Preparer Other Than Taxpayer

Under the pains and penalties of perjury, I declare that the information given in this statement is accurate and that I have personal knowledge of the

taxpayer’s financial condition.

Preparer’s signature

Preparer’s name (print)

Date

If you are filing as an individual or self-employed taxpayer do not complete Part 2. If filing as a corporate officer, individual partner or responsible person

you must also complete Part 2. All corporations or other business taxpayers must complete Part 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12