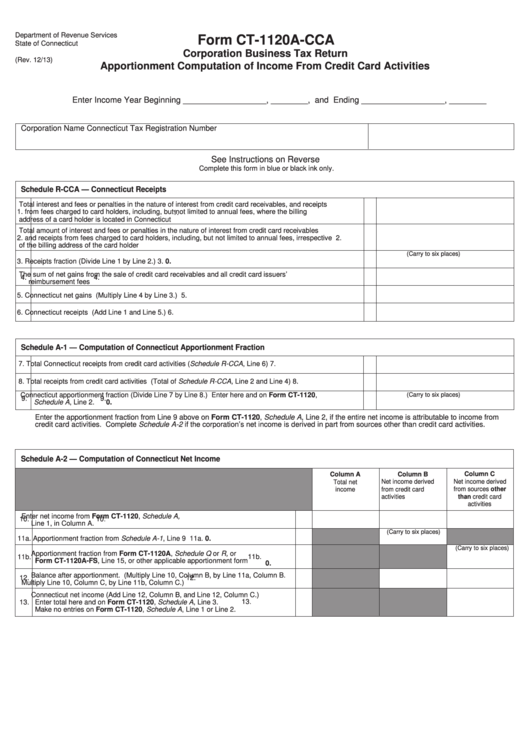

Form Ct-1120a-Cca - Corporation Business Tax Return Apportionment Computation Of Income From Credit Card Activities

ADVERTISEMENT

Department of Revenue Services

Form CT-1120A-CCA

State of Connecticut

Corporation Business Tax Return

(Rev. 12/13)

Apportionment Computation of Income From Credit Card Activities

Enter Income

YEnter Income Year Beginning __________________, ________, and Ending __________________, ________

Corporation Name

Connecticut Tax Registration Number

See Instructions on Reverse

Complete this form in blue or black ink only.

Schedule R-CCA — Connecticut Receipts

Total interest and fees or penalties in the nature of interest from credit card receivables, and receipts

1. from fees charged to card holders, including, but not limited to annual fees, where the billing

1.

address of a card holder is located in Connecticut

Total amount of interest and fees or penalties in the nature of interest from credit card receivables

2. and receipts from fees charged to card holders, including, but not limited to annual fees, irrespective

2.

of the billing address of the card holder

(Carry to six places)

3. Receipts fraction (Divide Line 1 by Line 2.)

3.

0.

The sum of net gains from the sale of credit card receivables and all credit card issuers’

4.

4.

reimbursement fees

5. Connecticut net gains (Multiply Line 4 by Line 3.)

5.

6. Connecticut receipts (Add Line 1 and Line 5.)

6.

Schedule A-1 — Computation of Connecticut Apportionment Fraction

7. Total Connecticut receipts from credit card activities (Schedule R-CCA, Line 6)

7.

8. Total receipts from credit card activities (Total of Schedule R-CCA, Line 2 and Line 4)

8.

Connecticut apportionment fraction (Divide Line 7 by Line 8.) Enter here and on Form CT-1120,

(Carry to six places)

9.

9.

Schedule A, Line 2.

0.

Enter the apportionment fraction from Line 9 above on Form CT-1120, Schedule A, Line 2, if the entire net income is attributable to income from

credit card activities. Complete Schedule A-2 if the corporation’s net income is derived in part from sources other than credit card activities.

Schedule A-2 — Computation of Connecticut Net Income

Column C

Column A

Column B

Total net

Net income derived

Net income derived

income

from credit card

from sources other

activities

than credit card

activities

Enter net income from Form CT-1120, Schedule A,

10.

10.

Line 1, in Column A.

(Carry to six places)

11a. Apportionment fraction from Schedule A-1, Line 9

11a.

0.

(Carry to six places)

11b. Apportionment fraction from Form CT-1120A, Schedule Q or R, or

11b.

Form CT-1120A-FS, Line 15, or other applicable apportionment form

0.

12. Balance after apportionment. (Multiply Line 10, Column B, by Line 11a, Column B.

12.

Multiply Line 10, Column C, by Line 11b, Column C.)

Connecticut net income (Add Line 12, Column B, and Line 12, Column C.)

13.

13.

Enter total here and on Form CT-1120, Schedule A, Line 3.

Make no entries on Form CT-1120, Schedule A, Line 1 or Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2