Form Ct-1120a-Sbc - Corporation Business Tax Return Apportionment Computation - Securities Brokerage Services

ADVERTISEMENT

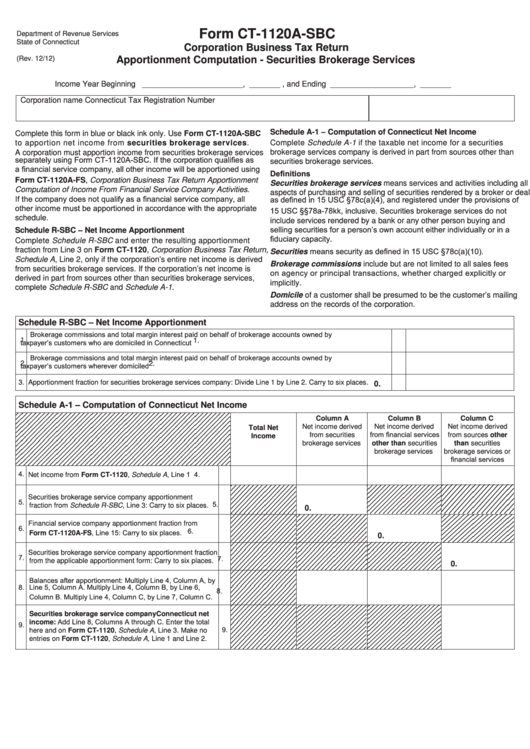

Form CT-1120A-SBC

Department of Revenue Services

State of Connecticut

Corporation Business Tax Return

(Rev. 12/12)

Apportionment Computation - Securities Brokerage Services

Enter

Income Year Beginning _______________________ , _______ , and Ending ___________________ , _______

Corporation name

Connecticut Tax Registration Number

Schedule A-1 – Computation of Connecticut Net Income

Complete this form in blue or black ink only. Use Form CT-1120A-SBC

to apportion net income from securities brokerage services.

Complete Schedule A-1 if the taxable net income for a securities

brokerage services company is derived in part from sources other than

A corporation must apportion income from securities brokerage services

separately using Form CT-1120A-SBC. If the corporation qualifies as

securities brokerage services.

a financial service company, all other income will be apportioned using

Definitions

Form CT-1120A-FS, Corporation Business Tax Return Apportionment

Securities brokerage services means services and activities including all

Computation of Income From Financial Service Company Activities.

aspects of purchasing and selling of securities rendered by a broker or dealer

If the company does not qualify as a financial service company, all

as defined in 15 USC §78c(a)(4), and registered under the provisions of

other income must be apportioned in accordance with the appropriate

15 USC §§78a-78kk, inclusive. Securities brokerage services do not

schedule.

include services rendered by a bank or any other person buying and

selling securities for a person’s own account either individually or in a

Schedule R-SBC – Net Income Apportionment

fiduciary capacity.

Complete Schedule R-SBC and enter the resulting apportionment

Securities means security as defined in 15 USC §78c(a)(10).

fraction from Line 3 on Form CT-1120, Corporation Business Tax Return,

Schedule A, Line 2, only if the corporation’s entire net income is derived

Brokerage commissions include but are not limited to all sales fees

from securities brokerage services. If the corporation’s net income is

on agency or principal transactions, whether charged explicitly or

derived in part from sources other than securities brokerage services,

implicitly.

complete Schedule R-SBC and Schedule A-1.

Domicile of a customer shall be presumed to be the customer’s mailing

address on the records of the corporation.

Schedule R-SBC – Net Income Apportionment

Brokerage commissions and total margin interest paid on behalf of brokerage accounts owned by

1.

1.

taxpayer’s customers who are domiciled in Connecticut ...............................................................................................

Brokerage commissions and total margin interest paid on behalf of brokerage accounts owned by

2.

2.

taxpayer’s customers wherever domiciled .....................................................................................................................

3. Apportionment fraction for securities brokerage services company: Divide Line 1 by Line 2. Carry to six places. .......

3.

0.

Schedule A-1 – Computation of Connecticut Net Income

Column A

Column B

Column C

Net income derived

Net income derived

Net income derived

Total Net

from financial services

from securities

from sources other

Income

other than securities

than securities

brokerage services

brokerage services

brokerage services or

financial services

4. Net income from Form CT-1120, Schedule A, Line 1

4.

Securities brokerage service company apportionment

5.

5.

fraction from Schedule R-SBC, Line 3: Carry to six places.

0.

Financial service company apportionment fraction from

6.

Form CT-1120A-FS, Line 15: Carry to six places.

6.

0.

Securities brokerage service company apportionment fraction

7.

7.

from the applicable apportionment form: Carry to six places.

0.

Balances after apportionment: Multiply Line 4, Column A, by

8.

Line 5, Column A. Multiply Line 4, Column B, by Line 6,

8.

Column B. Multiply Line 4, Column C, by Line 7, Column C.

Securities brokerage service company Connecticut net

income: Add Line 8, Columns A through C. Enter the total

9.

9.

here and on Form CT-1120, Schedule A, Line 3. Make no

entries on Form CT-1120, Schedule A, Line 1 and Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1