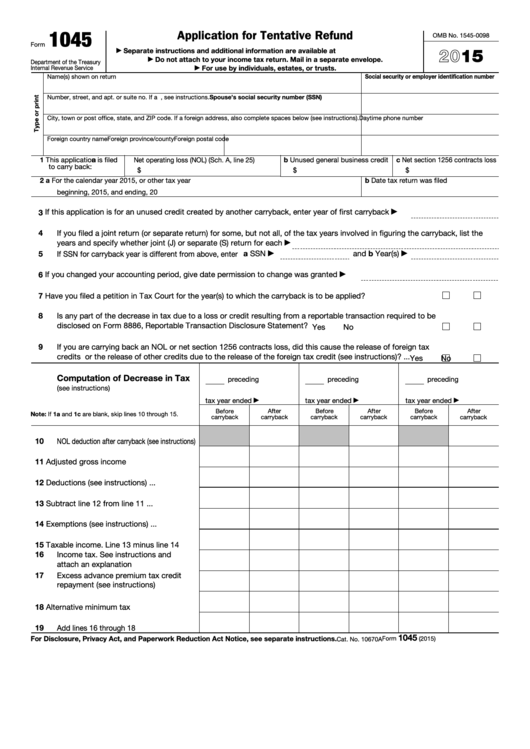

1045

Application for Tentative Refund

OMB No. 1545-0098

Form

2015

Separate instructions and additional information are available at

▶

Do not attach to your income tax return. Mail in a separate envelope.

▶

Department of the Treasury

For use by individuals, estates, or trusts.

Internal Revenue Service

▶

Name(s) shown on return

Social security or employer identification number

Number, street, and apt. or suite no. If a P.O. box, see instructions.

Spouse’s social security number (SSN)

City, town or post office, state, and ZIP code. If a foreign address, also complete spaces below (see instructions).

Daytime phone number

Foreign country name

Foreign province/county

Foreign postal code

1 This application is filed

a Net operating loss (NOL) (Sch. A, line 25)

b Unused general business credit

c Net section 1256 contracts loss

to carry back:

$

$

$

2 a

b Date tax return was filed

For the calendar year 2015, or other tax year

beginning

, 2015, and ending

, 20

If this application is for an unused credit created by another carryback, enter year of first carryback

3

▶

4

If you filed a joint return (or separate return) for some, but not all, of the tax years involved in figuring the carryback, list the

years and specify whether joint (J) or separate (S) return for each

▶

If SSN for carryback year is different from above, enter a SSN

and b Year(s)

5

▶

▶

If you changed your accounting period, give date permission to change was granted

6

▶

7

Have you filed a petition in Tax Court for the year(s) to which the carryback is to be applied?

.

.

.

.

.

Yes

No

8

Is any part of the decrease in tax due to a loss or credit resulting from a reportable transaction required to be

disclosed on Form 8886, Reportable Transaction Disclosure Statement? .

.

.

.

.

.

.

.

.

.

.

.

Yes

No

9

If you are carrying back an NOL or net section 1256 contracts loss, did this cause the release of foreign tax

credits or the release of other credits due to the release of the foreign tax credit (see instructions)? .

.

.

Yes

No

Computation of Decrease in Tax

preceding

preceding

preceding

(see instructions)

tax year ended

tax year ended

tax year ended

▶

▶

▶

Before

After

Before

After

Before

After

Note: If 1a and 1c are blank, skip lines 10 through 15.

carryback

carryback

carryback

carryback

carryback

carryback

10

NOL deduction after carryback (see instructions)

11

Adjusted gross income

.

.

.

.

.

12

Deductions (see instructions)

.

.

.

13

Subtract line 12 from line 11

.

.

.

14

Exemptions (see instructions) .

.

.

15

Taxable income. Line 13 minus line 14

16

Income tax. See instructions and

attach an explanation .

.

.

.

.

.

17

Excess advance premium tax credit

repayment (see instructions) .

.

.

.

18

Alternative minimum tax .

.

.

.

.

19

Add lines 16 through 18

.

.

.

.

.

1045

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

Form

(2015)

Cat. No. 10670A

1

1 2

2 3

3 4

4 5

5