2

Schedule H (Form 990) 2015

Page

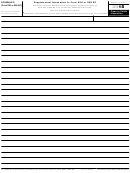

Part II

Community Building Activities Complete this table if the organization conducted any community building

activities during the tax year, and describe in Part VI how its community building activities promoted the

health of the communities it serves.

(a) Number of

(b) Persons

(c) Total community

(d) Direct offsetting

(e) Net community

(f) Percent of

activities or

served

building expense

revenue

building expense

total expense

programs

(optional)

(optional)

1

Physical improvements and housing

2

Economic development

3

Community support

4

Environmental improvements

5

Leadership development and training

for community members

6

Coalition building

7

Community health improvement advocacy

8

Workforce development

9

Other

10

Total

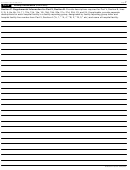

Part III

Bad Debt, Medicare, & Collection Practices

Section A. Bad Debt Expense

Yes No

1

1

Did the organization report bad debt expense in accordance with Healthcare Financial Management Association Statement No. 15?

Enter the amount of the organization’s bad debt expense. Explain in Part VI the

2

methodology used by the organization to estimate this amount .

.

.

.

.

.

.

.

.

2

3

Enter the estimated amount of the organization’s bad debt expense attributable to

patients eligible under the organization’s financial assistance policy. Explain in Part VI the

methodology used by the organization to estimate this amount and the rationale, if any,

for including this portion of bad debt as community benefit. .

.

.

.

.

.

.

.

.

.

3

4

Provide in Part VI the text of the footnote to the organization’s financial statements that describes bad debt

expense or the page number on which this footnote is contained in the attached financial statements.

Section B. Medicare

5

Enter total revenue received from Medicare (including DSH and IME) .

.

.

.

.

.

.

5

6

Enter Medicare allowable costs of care relating to payments on line 5 .

.

.

.

.

.

.

6

7

7

Subtract line 6 from line 5. This is the surplus (or shortfall) .

.

.

.

.

.

.

.

.

.

.

8

Describe in Part VI the extent to which any shortfall reported in line 7 should be treated as community

benefit. Also describe in Part VI the costing methodology or source used to determine the amount reported

on line 6. Check the box that describes the method used:

Cost accounting system

Cost to charge ratio

Other

Section C. Collection Practices

9

9a

Did the organization have a written debt collection policy during the tax year? .

.

.

.

.

.

.

.

.

.

a

If “Yes,” did the organization’s collection policy that applied to the largest number of its patients during the tax year contain provisions

b

on the collection practices to be followed for patients who are known to qualify for financial assistance? Describe in Part VI .

.

.

9b

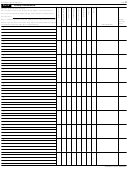

Part IV

Management Companies and Joint Ventures

(owned 10% or more by officers, directors, trustees, key employees, and physicians—see instructions)

(a) Name of entity

(b) Description of primary

(c) Organization’s

(d) Officers, directors,

(e) Physicians’

trustees, or key

activity of entity

profit % or stock

profit % or stock

employees’ profit %

ownership %

ownership %

or stock ownership %

1

2

3

4

5

6

7

8

9

10

11

12

13

Schedule H (Form 990) 2015

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9