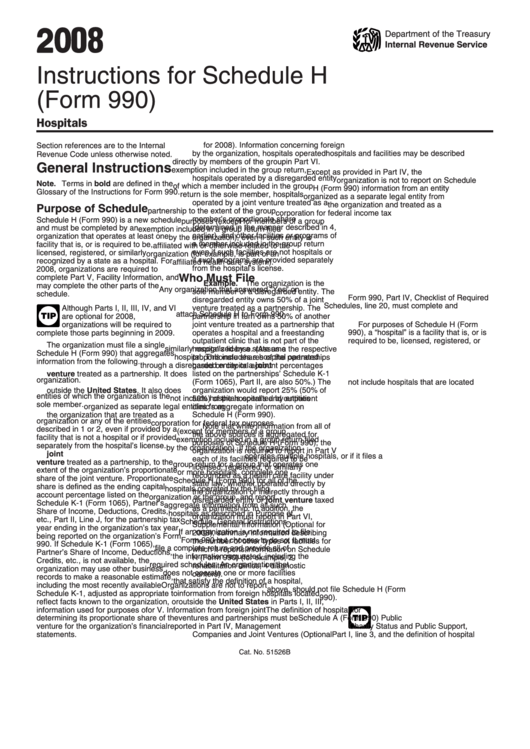

2008 Instructions For Schedule H (Form 990)

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Schedule H

(Form 990)

Hospitals

5. In the case of a group return filed

for 2008). Information concerning foreign

Section references are to the Internal

by the organization, hospitals operated

hospitals and facilities may be described

Revenue Code unless otherwise noted.

directly by members of the group

in Part VI.

General Instructions

exemption included in the group return,

Except as provided in Part IV, the

hospitals operated by a disregarded entity

organization is not to report on Schedule

Note. Terms in bold are defined in the

of which a member included in the group

H (Form 990) information from an entity

Glossary of the Instructions for Form 990.

return is the sole member, hospitals

organized as a separate legal entity from

operated by a joint venture treated as a

the organization and treated as a

Purpose of Schedule

partnership to the extent of the group

corporation for federal income tax

member’s proportionate share

Schedule H (Form 990) is a new schedule

purposes (except for members of a group

(determined in the manner described in 4,

and must be completed by an

exemption included in a group return filed

earlier), and other facilities or programs of

organization that operates at least one

by the organization), even if such entity is

a member included in the group return

facility that is, or is required to be,

affiliated with or otherwise related to the

even if such facilities are not hospitals or

licensed, registered, or similarly

organization (for example, is part of an

if such programs are provided separately

recognized by a state as a hospital. For

affiliated health care system).

from the hospital’s license.

2008, organizations are required to

Who Must File

complete Part V, Facility Information, and

Example. The organization is the

may complete the other parts of the

Any organization that answered “Yes” on

sole member of a disregarded entity. The

schedule.

Form 990, Part IV, Checklist of Required

disregarded entity owns 50% of a joint

Schedules, line 20, must complete and

Although Parts I, II, III, IV, and VI

venture treated as a partnership. The

attach Schedule H to Form 990.

TIP

are optional for 2008,

partnership in turn owns 50% of another

organizations will be required to

joint venture treated as a partnership that

For purposes of Schedule H (Form

complete those parts beginning in 2009.

operates a hospital and a freestanding

990), a “hospital” is a facility that is, or is

outpatient clinic that is not part of the

required to be, licensed, registered, or

The organization must file a single

hospital’s license. (Assume the respective

similarly recognized by a state as a

Schedule H (Form 990) that aggregates

proportionate shares of the partnerships

hospital. This includes a hospital operated

information from the following.

based on capital account percentages

through a disregarded entity or a joint

1. Hospitals directly operated by the

listed on the partnerships’ Schedule K-1

venture treated as a partnership. It does

organization.

(Form 1065), Part II, are also 50%.) The

not include hospitals that are located

2. Hospitals operated by disregarded

organization would report 25% (50% of

outside the United States. It also does

entities of which the organization is the

50%) of the hospital’s and outpatient

not include hospitals operated by entities

sole member.

clinic’s aggregate information on

organized as separate legal entities from

3. Other facilities or programs of the

Schedule H (Form 990).

the organization that are treated as a

organization or any of the entities

corporation for federal tax purposes

Note that while information from all of

described in 1 or 2, even if provided by a

(except for members of a group

the above sources is aggregated for

facility that is not a hospital or if provided

exemption included in a group return filed

purposes of Schedule H (Form 990), the

separately from the hospital’s license.

by the organization). If the organization

organization is required to report in Part V

4. Hospitals operated by any joint

operates multiple hospitals, or if it files a

each of its facilities required to be

venture treated as a partnership, to the

group return for a group that operates one

licensed, registered, or similarly

extent of the organization’s proportionate

or more hospitals, complete one

recognized as a health care facility under

share of the joint venture. Proportionate

Schedule H (Form 990) for all of the

state law, whether operated directly by

share is defined as the ending capital

hospitals operated by the filing

the organization or indirectly through a

account percentage listed on the

organization or the group, and report

disregarded entity or joint venture taxed

Schedule K-1 (Form 1065), Partner’s

aggregate information from all such

as a partnership. In addition, the

Share of Income, Deductions, Credits,

hospitals as described in Purpose of

organization must report in Part VI,

etc., Part II, Line J, for the partnership tax

Schedule, General Instructions.

Supplemental Information (Optional for

year ending in the organization’s tax year

If an organization is not required to file

2008), summary information describing

being reported on the organization’s Form

Form 990 but chooses to do so, it must

the number of other types of facilities for

990. If Schedule K-1 (Form 1065),

file a complete return and provide all of

which it reports information on Schedule

Partner’s Share of Income, Deductions,

the information requested, including the

H (Form 990) (for example, 2

Credits, etc., is not available, the

required schedules. An organization that

rehabilitation clinics, 4 diagnostic

organization may use other business

does not operate one or more facilities

centers).

records to make a reasonable estimate,

that satisfy the definition of a hospital,

including the most recently available

Organizations are not to report

above, should not file Schedule H (Form

Schedule K-1, adjusted as appropriate to

information from foreign hospitals located

990).

reflect facts known to the organization, or

outside the United States in Parts I, II, III,

information used for purposes of

or V. Information from foreign joint

The definition of hospital for

TIP

determining its proportionate share of the

ventures and partnerships must be

Schedule A (Form 990) Public

venture for the organization’s financial

reported in Part IV, Management

Charity Status and Public Support,

statements.

Companies and Joint Ventures (Optional

Part I, line 3, and the definition of hospital

Cat. No. 51526B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15