Form Ct-1120gb - Green Buildings Tax Credit - 2013

ADVERTISEMENT

Department of Revenue Services

2013

Form CT-1120GB

State of Connecticut

(Rev. 12/13)

Green Buildings Tax Credit

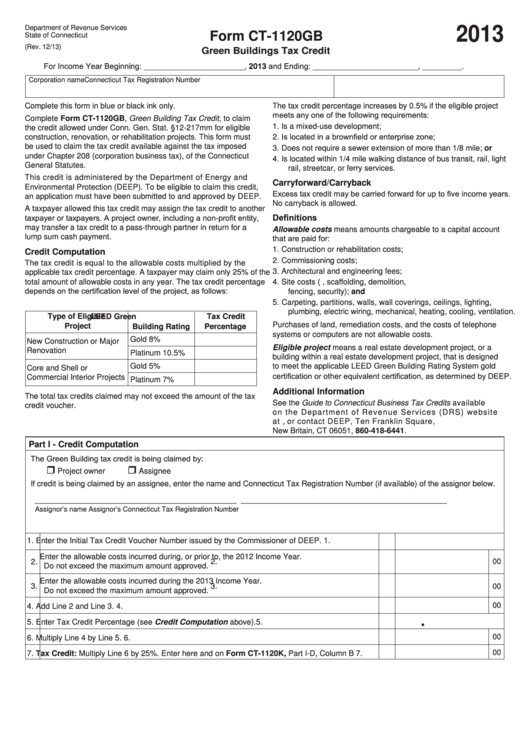

For Income Year Beginning: _______________________ , 2013 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

The tax credit percentage increases by 0.5% if the eligible project

meets any one of the following requirements:

Complete Form CT-1120GB, Green Building Tax Credit, to claim

1.

Is a mixed-use development;

the credit allowed under Conn. Gen. Stat. §12-217mm for eligible

Is located in a brownfield or enterprise zone;

construction, renovation, or rehabilitation projects. This form must

2.

be used to claim the tax credit available against the tax imposed

3.

Does not require a sewer extension of more than 1/8 mile; or

under Chapter 208 (corporation business tax), of the Connecticut

4.

Is located within 1/4 mile walking distance of bus transit, rail, light

General Statutes.

rail, streetcar, or ferry services.

This credit is administered by the Department of Energy and

Carryforward/Carryback

Environmental Protection (DEEP). To be eligible to claim this credit,

Excess tax credit may be carried forward for up to five income years.

an application must have been submitted to and approved by DEEP.

No carryback is allowed.

A taxpayer allowed this tax credit may assign the tax credit to another

Definitions

taxpayer or taxpayers. A project owner, including a non-profit entity,

may transfer a tax credit to a pass-through partner in return for a

Allowable costs means amounts chargeable to a capital account

that are paid for:

lump sum cash payment.

1.

Construction or rehabilitation costs;

Credit Computation

2.

Commissioning costs;

The tax credit is equal to the allowable costs multiplied by the

3.

Architectural and engineering fees;

applicable tax credit percentage. A taxpayer may claim only 25% of the

total amount of allowable costs in any year. The tax credit percentage

4.

Site costs (e.g. temporary electric wiring, scaffolding, demolition,

depends on the certification level of the project, as follows:

fencing, security); and

5.

Carpeting, partitions, walls, wall coverings, ceilings, lighting,

plumbing, electric wiring, mechanical, heating, cooling, ventilation.

Type of Eligible

LEED Green

Tax Credit

Purchases of land, remediation costs, and the costs of telephone

Project

Building Rating

Percentage

systems or computers are not allowable costs.

Gold

8%

New Construction or Major

Eligible project means a real estate development project, or a

Renovation

Platinum

10.5%

building within a real estate development project, that is designed

Gold

5%

to meet the applicable LEED Green Building Rating System gold

Core and Shell or

certification or other equivalent certification, as determined by DEEP.

Commercial Interior Projects

Platinum

7%

Additional Information

The total tax credits claimed may not exceed the amount of the tax

See the Guide to Connecticut Business Tax Credits available

credit voucher.

on the Department of Revenue Services (DRS) website

at , or contact DEEP, Ten Franklin Square,

New Britain, CT 06051, 860-418-6441.

Part I - Credit Computation

The Green Building tax credit is being claimed by:

Project owner

Assignee

If credit is being claimed by an assignee, enter the name and Connecticut Tax Registration Number (if available) of the assignor below.

______________________________________________

_______________________________________________

Assignor’s name

Assignor’s Connecticut Tax Registration Number

1. Enter the Initial Tax Credit Voucher Number issued by the Commissioner of DEEP.

1.

Enter the allowable costs incurred during, or prior to, the 2012 Income Year.

00

2.

2.

Do not exceed the maximum amount approved.

Enter the allowable costs incurred during the 2013 Income Year.

3.

3.

00

Do not exceed the maximum amount approved.

00

4. Add Line 2 and Line 3.

4.

.

5. Enter Tax Credit Percentage (see Credit Computation above).

5.

00

6. Multiply Line 4 by Line 5.

6.

00

7. Tax Credit: Multiply Line 6 by 25%. Enter here and on Form CT-1120K, Part I-D, Column B

7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2