Form Ct-1120gb - Green Buildings Tax Credit - 2015

ADVERTISEMENT

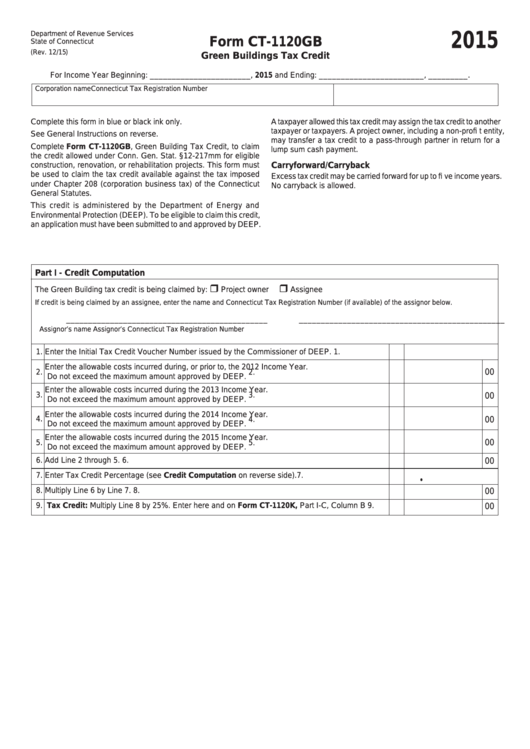

Department of Revenue Services

2015

Form CT-1120GB

State of Connecticut

(Rev. 12/15)

Green Buildings Tax Credit

For Income Year Beginning: _______________________ , 2015 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

A taxpayer allowed this tax credit may assign the tax credit to another

taxpayer or taxpayers. A project owner, including a non-profi t entity,

See General Instructions on reverse.

may transfer a tax credit to a pass-through partner in return for a

Complete Form CT-1120GB, Green Building Tax Credit, to claim

lump sum cash payment.

the credit allowed under Conn. Gen. Stat. §12-217mm for eligible

construction, renovation, or rehabilitation projects. This form must

Carryforward/Carryback

be used to claim the tax credit available against the tax imposed

Excess tax credit may be carried forward for up to fi ve income years.

under Chapter 208 (corporation business tax) of the Connecticut

No carryback is allowed.

General Statutes.

This credit is administered by the Department of Energy and

Environmental Protection (DEEP). To be eligible to claim this credit,

an application must have been submitted to and approved by DEEP.

Part I - Credit Computation

The Green Building tax credit is being claimed by:

Project owner

Assignee

If credit is being claimed by an assignee, enter the name and Connecticut Tax Registration Number (if available) of the assignor below.

______________________________________________

_______________________________________________

Assignor’s name

Assignor’s Connecticut Tax Registration Number

1. Enter the Initial Tax Credit Voucher Number issued by the Commissioner of DEEP.

1.

Enter the allowable costs incurred during, or prior to, the 2012 Income Year.

00

2.

2.

Do not exceed the maximum amount approved by DEEP.

Enter the allowable costs incurred during the 2013 Income Year.

3.

3.

00

Do not exceed the maximum amount approved by DEEP.

Enter the allowable costs incurred during the 2014 Income Year.

4.

00

4.

Do not exceed the maximum amount approved by DEEP.

Enter the allowable costs incurred during the 2015 Income Year.

00

5.

5.

Do not exceed the maximum amount approved by DEEP.

6. Add Line 2 through 5.

6.

00

.

7. Enter Tax Credit Percentage (see Credit Computation on reverse side).

7.

8. Multiply Line 6 by Line 7.

8.

00

9. Tax Credit: Multiply Line 8 by 25%. Enter here and on Form CT-1120K, Part I-C, Column B

9.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2