Form Ct-185 - Cooperative Agricultural Corporation Franchise Tax Return - 2013

ADVERTISEMENT

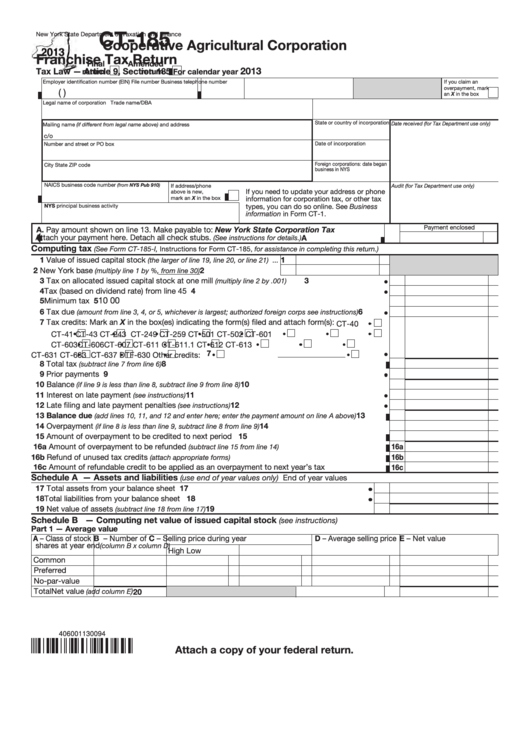

CT-185

New York State Department of Taxation and Finance

Cooperative Agricultural Corporation

Franchise Tax Return

Final

Amended

2013

Tax Law — Article 9, Section 185

return

return

For calendar year

Employer identification number (EIN)

File number

Business telephone number

If you claim an

overpayment, mark

(

)

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above) and address

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

(from NYS Pub 910)

If address/phone

Audit (for Tax Department use only)

If you need to update your address or phone

above is new,

mark an X in the box

information for corporation tax, or other tax

NYS principal business activity

types, you can do so online. See Business

information in Form CT-1.

Payment enclosed

A. Pay amount shown on line 13. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

A

(See instructions for details.)

Computing tax

(See Form CT-185-I, Instructions for Form CT-185, for assistance in completing this return.)

1 Value of issued capital stock

1

(the larger of line 19, line 20, or line 21) ...

2 New York base

2

...........

(multiply line 1 by

%, from line 30)

3 Tax on allocated issued capital stock at one mill

3

(multiply line 2 by .001) .................................................

4 Tax (based on dividend rate) from line 45 ........................................................................................

4

10 00

5 Minimum tax ......................................................................................................................................

5

6 Tax due

6

...........

(amount from line 3, 4, or 5, whichever is largest; authorized foreign corps see instructions)

7 Tax credits: Mark an X in the box(es) indicating the form(s) filed and attach form(s):

CT-40

CT-41

CT-43

CT-243

CT-249

CT-259

CT-501

CT-502

CT-601

CT-603

CT-606

CT-607

CT-611

CT-611.1

CT-612

CT-613

7

CT-631

CT-633

CT-637

DTF-630

Other credits:

........

8 Total tax

....................................................................................................

8

(subtract line 7 from line 6)

9 Prior payments .................................................................................................................................

9

10 Balance

..................................................................

10

(if line 9 is less than line 8, subtract line 9 from line 8)

11 Interest on late payment

.........................................................................................

11

(see instructions)

12 Late filing and late payment penalties

12

....................................................................

(see instructions)

13 Balance due

13

...........

(add lines 10, 11, and 12 and enter here; enter the payment amount on line A above)

14 Overpayment

.........................................................

14

(if line 8 is less than line 9, subtract line 8 from line 9)

15 Amount of overpayment to be credited to next period ....................................................................

15

16a Amount of overpayment to be refunded

16a

...............................................

(subtract line 15 from line 14)

16b Refund of unused tax credits

.....................................................................

16b

(attach appropriate forms)

16c Amount of refundable credit to be applied as an overpayment to next year’s tax ..........................

16c

Schedule A — Assets and liabilities

(use end of year values only)

End of year values

17 Total assets from your balance sheet .......................................................................................

17

18 Total liabilities from your balance sheet ....................................................................................

18

19 Net value of assets

........................................................................... 19

(subtract line 18 from line 17)

Schedule B — Computing net value of issued capital stock

(see instructions)

Part 1 — Average value

A – Class of stock

B – Number of

C – Selling price during year

D – Average selling price

E – Net value

shares at year end

(column B x column D)

High

Low

Common

Preferred

No-par-value

Total

Net value

)

(add column E

20

406001130094

Attach a copy of your federal return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2