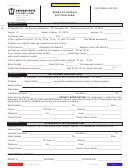

Form Rev-260ba - Board Of Finance And Revenue Petition Form Page 3

ADVERTISEMENT

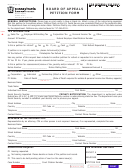

INSTRUCTIONS FOR THE PREPARATION AND FILING OF PETITIONS

GENERAL INSTRUCTIONS

Please type or print in ink. Petitions filed via U.S. Postal service are considered filed as of the

postmark date. Petitions filed via any other method are considered filed on the date received.

•

This Petition Form should be used to petition to the Board of Finance and Revenue for:

1. Review of a decision of the Board of Appeals or of an assessment, redetermination,

or resettlement made by the Department of Revenue.

2. Refund of monies paid to an agency of the Commonwealth, other than the Department of

Revenue, to which the Commonwealth is neither rightfully nor equitably entitled.*

*NOTE: As of January 1, 1995, all petitions for the refund of monies paid to the

Department of Revenue, except for refunds of Liquid Fuels Taxes paid by political

sudivisions; nonpublic schools not operated for profit; farmers; volunteer rescue

squads, ambulance services, and fire companies; users of liquid fuel in propeller

driven aircraft or engines; and agencies of the federal government and of the

Commonwealth, must be filed with the Department of Revenue's Board of Appeals.

•

All petitions must be filed within the time limits and in accordance with the applicable statutory

law for the type of tax involved. Petitions filed via the U.S. Postal Service are considered

filed as of the postmark date. Petitions hand delivered or filed via any other method are

considered filed on the date received.

•

Any evidence in support of the petition should be submitted along with the petition or as promptly

as possible thereafter. All evidential material must be submitted prior to five working days of the

hearing date.

•

Hearings before the Board of Finance and Revenue consist of an oral presentation before the six

member Board. No physical evidence or testimony is received during the hearing. Oral presenta-

tions are restricted to five (5) minutes unless prior thereto additional time is requested and it is

clear that more time may be required.

•

The Board may require, in any case, that a Power of Attorney, signed and executed by the

petitioner or claimant, be filed with the Board before recognizing any person as representing

the petitioner or claimant.

•

Only an attorney at law representing any petitioner or other applicant or an applicant acting in his

or her own behalf, shall be permitted to argue or discuss any legal questions at a hearing before

the Board.

•

Granting of continuances, for cause shown, shall be discretionary with the Board.

BFR-003A (2-00)

SPECIFIC INSTRUCTIONS ON OTHER SIDE

REV-260 BA

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4