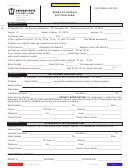

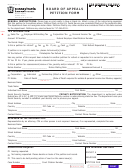

Form Rev-260ba - Board Of Finance And Revenue Petition Form Page 4

ADVERTISEMENT

SPECIFIC INSTRUCTIONS

Each number of the following instructions corresponds to the number of the appropriate

block on the face of the petition form. Complete all information applicable to your case.

1

If petitioning for review, always include the Board of Appeals Docket Number, and the mailing

date.

2

Complete all information in Block 2.

3

To be completed only if petitioner intends to be represented by another. If so, notice of the

hearing will be sent to the representative's address.

4

Indicate the type of tax; e.g., personal income, sales, corporate net income, etc., and the tax

year or period. Check one of the three blocks indicating type of petition. If petitioning for a

refund, indicate nature of the refund. A separate petition must be filed for each type of tax and

for each tax year or tax period. Fill in the taxpayer I.D. number and any assessment or

redetermination number assigned by the appropriate Bureau of the Department of Revenue

administering the petitioned tax.

5

Hearings are held in Harrisburg only. A taxpayer or taxpayer's representative need not attend

a hearing. The Board can decide the case based on the Petition and the record. If a hearing

is requested, notice of the hearing date will be sent to the taxpayer's representative or if

none, to the taxpayer. Where the determination of the issue or a taxpayer's case would be

governed by the decision of a case pending before the courts, the taxpayer has the option to:

A. Request that his or her case be continued until the courts render a decision in the

appealed case. After the courts have rendered a decision, the taxpayer's case can then

be listed for hearing or decided on the record.

B. Request that the Board hear the taxpayer's case and render a decision. Should the Board

render a decision adverse to the taxpayer, the taxpayer can then appeal his own case to

the Commonwealth Court.

6

While the Board does not advocate which of the two options taxpayers should choose,

taxpayers are advised that the Board will usually deny the taxpayer relief while the issue

involved is pending in the courts. This is because the case before the court is generally

challenging a Board decision and thus the Board, until advised to the contrary by the courts,

believes its position to be correct.

7

All petitions must be signed and notarized.

A. Briefly list all arguments or points of contention.

B. Every petition before the Board must contain a statement of all pertinent facts and/or

points of law upon which the petitioner relies. Any calculations showing how the claimed

proper amount of tax or refund is achieved should be shown. All evidence in support of

the arguments set forth should be submitted with the petition or as soon as possible.

Evidential material received later than five (5) working days prior to the hearing date may

not be considered by the Board in arriving at its decision.

GENERAL INSTRUCTIONS ON OTHER SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4