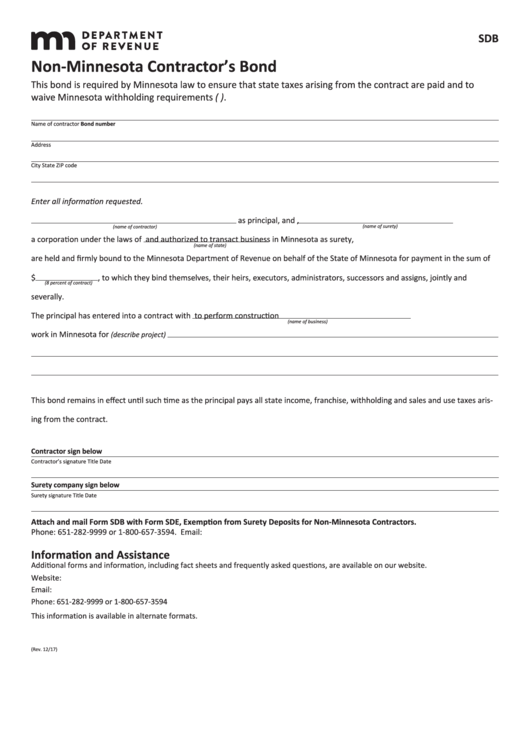

SDB

Non-Minnesota Contractor’s Bond

This bond is required by Minnesota law to ensure that state taxes arising from the contract are paid and to

waive Minnesota withholding requirements (M.S. 290.9705).

Name of contractor

Bond number

Address

City

State

ZIP code

Enter all information requested.

as principal, and

,

(name of surety)

(name of contractor)

a corporation under the laws of

and authorized to transact business in Minnesota as surety,

(name of state)

are held and firmly bound to the Minnesota Department of Revenue on behalf of the State of Minnesota for payment in the sum of

$

, to which they bind themselves, their heirs, executors, administrators, successors and assigns, jointly and

(8 percent of contract)

severally.

The principal has entered into a contract with

to perform construction

(name of business)

work in Minnesota for

(describe project)

This bond remains in effect until such time as the principal pays all state income, franchise, withholding and sales and use taxes aris-

ing from the contract.

Contractor sign below

Contractor’s signature

Title

Date

Surety company sign below

Surety signature

Title

Date

Attach and mail Form SDB with Form SDE, Exemption from Surety Deposits for Non-Minnesota Contractors.

Phone: 651-282-9999 or 1-800-657-3594. Email: withholding.tax@state.mn.us

Information and Assistance

Additional forms and information, including fact sheets and frequently asked questions, are available on our website.

Website:

Email:

withholding.tax@state.mn.us

Phone: 651-282-9999 or 1-800-657-3594

This information is available in alternate formats.

(Rev. 12/17)

1

1