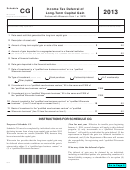

Instructions for the Regulated Investment

RIC’s or REIT’s name, address, and identification number. Enter

the name, address (including ZIP code) and employer identification

Company (RIC) and the Real Estate Investment

number (EIN) of the RIC or REIT as shown on Form 2438,

Trust (REIT)

Undistributed Capital Gains Tax Return.

Shareholder’s identifying number, name, and address. Enter the

Section references are to the Internal Revenue Code.

shareholder’s social security number (SSN), name, and address

Reporting Information

(including ZIP code). If the shareholder is not an individual, enter the

1. Complete Copies A, B, C, and D for each shareholder for

EIN. If a shareholder is an IRA, enter the identification number of the

whom the regulated investment company (RIC) or real estate

IRA trust. Do not enter the SSN of the person for whom the IRA is

investment trust (REIT) paid tax on undistributed capital gains under

maintained.

section 852(b)(3)(D) or 857(b)(3)(D).

Box 1a. Enter the amount of undistributed capital gains from

2. Attach Copy A of all Forms 2439 to Form 1120-RIC or Form

line 11, Form 2438, allocable to the shareholder.

1120-REIT when it is filed at the appropriate IRS service center.

Box 1b. Enter the shareholder’s allocable portion of the amount

3. Furnish Copies B and C of Form 2439 to the shareholder by the

from box 1a that has been designated as unrecaptured section

60th day after the end of the RIC’s or the REIT’s tax year.

1250 gain from the disposition of depreciable real property.

4. Retain Copy D for the RIC’s or REIT’s records.

(Continued on the back of Copy D)

▲

For a shareholder that is an individual retirement

!

arrangement (IRA), send Copies B and C to the trustee or

custodian of the IRA. Do not send copies to the owner of

CAUTION

the IRA.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8