Form 51a401 - Governmental Public Facility Application For Sales Tax Rebate

ADVERTISEMENT

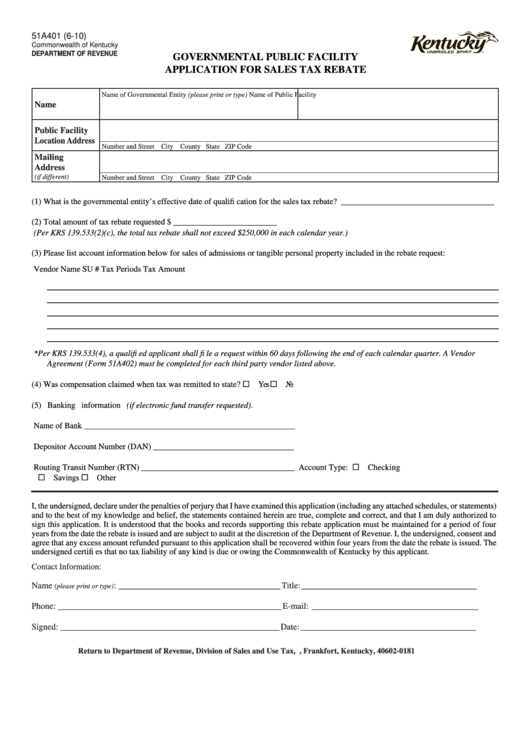

51A401 (6-10)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

GOVERNMENTAL PUBLIC FACILITY

APPLICATION FOR SALES TAX REBATE

Name of Governmental Entity (please print or type)

Name of Public Facility

Name

Public Facility

Location Address

Number and Street

City

County

State

ZIP Code

Mailing

Address

(if different)

Number and Street

City

County

State

ZIP Code

(1) What is the governmental entity’s effective date of qualifi cation for the sales tax rebate? _____________________________________

(2) Total amount of tax rebate requested $ _________________________

(Per KRS 139.533(2)(c), the total tax rebate shall not exceed $250,000 in each calendar year.)

(3) Please list account information below for sales of admissions or tangible personal property included in the rebate request:

Vendor Name

SU #

Tax Periods

Tax Amount

*Per KRS 139.533(4), a qualifi ed applicant shall fi le a request within 60 days following the end of each calendar quarter. A Vendor

Agreement (Form 51A402) must be completed for each third party vendor listed above.

(4) Was compensation claimed when tax was remitted to state?

Yes

No

(5) Banking information (if electronic fund transfer requested).

Name of Bank ___________________________________________________

Depositor Account Number (DAN) __________________________________

Routing Transit Number (RTN) _____________________________________

Account Type:

Checking

Savings

Other

I, the undersigned, declare under the penalties of perjury that I have examined this application (including any attached schedules, or statements)

and to the best of my knowledge and belief, the statements contained herein are true, complete and correct, and that I am duly authorized to

sign this application. It is understood that the books and records supporting this rebate application must be maintained for a period of four

years from the date the rebate is issued and are subject to audit at the discretion of the Department of Revenue. I, the undersigned, consent and

agree that any excess amount refunded pursuant to this application shall be recovered within four years from the date the rebate is issued. The

undersigned certifi es that no tax liability of any kind is due or owing the Commonwealth of Kentucky by this applicant.

Contact Information:

Name

: _____________________________________

Title: ________________________________________

(please print or type)

Phone: ___________________________________________________

E-mail: ______________________________________

Signed: __________________________________________________

Date: ________________________________________

Return to Department of Revenue, Division of Sales and Use Tax, P.O. Box 181, Frankfort, Kentucky, 40602-0181

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1