used to calculate the natural resource credit, multiplied by

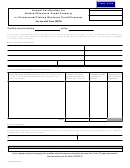

Credit Computation

[(five minus the number of years the property was used as

natural resource property) divided by five]. The property

The natural resource credit is computed by multiplying

the tax that would be payable (ORS 118.005 to ORS 118.840),

owner will pay the additional tax at the time of the dis-

absent the credit by a ratio, the numerator of which is an

position of the property or the disqualifying event. Each

amount equal to the lesser of the amount of natural resource

property owner will need to file Form OR706-A, Additional

property or $7.5 million, and the denominator of which is an

Oregon Estate Transfer Tax Return, 150-104-007. This return

amount equal to the total adjusted gross estate.

and the additional tax are due six months after the date of

Example: If an estate had a adjusted gross estate of

disposition of the property. For examples of the additional

$2,000,000, natural resource property of $1,200,000, and tax

tax due, see Form OR706-A and instructions.

payable to Oregon of $101,250, the credit would be $60,750,

computed as follows:

• The payment of federal estate taxes, state inheritance, or

101,250 * (1,200,000 / 2,000,000) = 60,750

estate taxes from cash or other assets for which a natural

resource credit was claimed, shall be a disposition and an

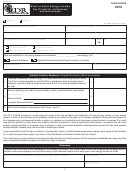

Annual Certification for Natural

additional tax shall be imposed.

Resource Credit

[ORS 118.140(10)]

• The conveyance after the decedent’s death of property

that otherwise meets the requirements of this section

The heir who inherits the natural resource property will

and is conveyed as a qualified conservation contribution

need to file the Annual Certification for Natural Resource Credit

Property or Commercial Fishing Business Credit Property form,

[IRC 170(h)], is not a disposition requiring payment of

150-104-008, with us. This form certifies the heir’s continued

additional tax under this subsection.

qualified use of the property, this form is due April 15th.

• Natural resource property may be replaced with real

property or personal property after the credit is claimed

Disposition of natural resource property

and does not result in a disposition subject to an addition-

and additional tax due

[ORS 118.140(9)(a)]

al tax if the replacement property is used in the operation

An additional tax may be imposed per ORS 118.005 to

of the farm business, forestry business or fishing busi-

118.540 if the natural resource property or commercial fish-

ness. Real property for which a credit is claimed under

ing business property is disposed of or is transferred to a

this section may be replaced only with real property that

person other than a family member or another eligible entity,

would otherwise qualify as natural resource property.

before the property is used for five out of eight years after

The replacement must be made within one year to avoid

the date of death.

a disposition and additional tax, with the exception that

The additional tax liability is the amount of the additional

involuntarily converted replacement property must occur

tax that would have been imposed, had the disqualified

property not been included in the numerator of the ratio

within two years (IRC 1033).

150-104-003 (Rev. 06-12)

Instructions for Schedule NRC for Form OR706, page 2 of 5

1

1 2

2 3

3 4

4 5

5