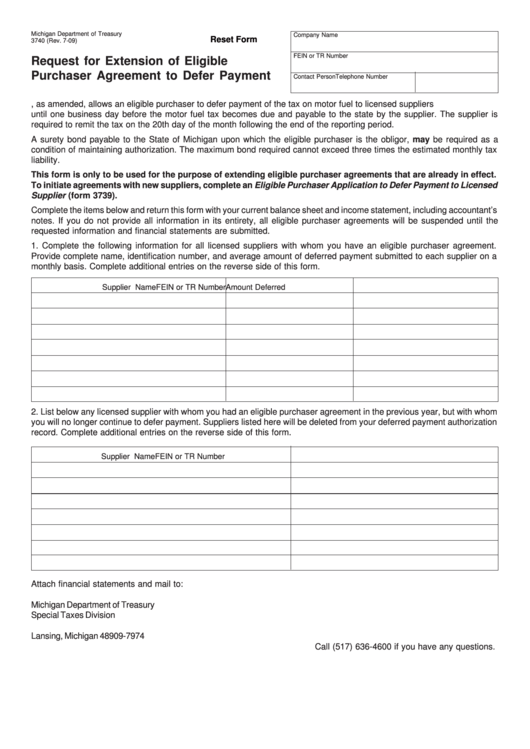

Michigan Department of Treasury

Company Name

Reset Form

3740 (Rev. 7-09)

FEIN or TR Number

Request for Extension of Eligible

Purchaser Agreement to Defer Payment

Contact Person

Telephone Number

P.A. 403 of 2000, as amended, allows an eligible purchaser to defer payment of the tax on motor fuel to licensed suppliers

until one business day before the motor fuel tax becomes due and payable to the state by the supplier. The supplier is

required to remit the tax on the 20th day of the month following the end of the reporting period.

A surety bond payable to the State of Michigan upon which the eligible purchaser is the obligor, may be required as a

condition of maintaining authorization. The maximum bond required cannot exceed three times the estimated monthly tax

liability.

This form is only to be used for the purpose of extending eligible purchaser agreements that are already in effect.

To initiate agreements with new suppliers, complete an Eligible Purchaser Application to Defer Payment to Licensed

Supplier (form 3739).

Complete the items below and return this form with your current balance sheet and income statement, including accountant’s

notes. If you do not provide all information in its entirety, all eligible purchaser agreements will be suspended until the

requested information and financial statements are submitted.

1. Complete the following information for all licensed suppliers with whom you have an eligible purchaser agreement.

Provide complete name, identification number, and average amount of deferred payment submitted to each supplier on a

monthly basis. Complete additional entries on the reverse side of this form.

Supplier Name

FEIN or TR Number

Amount Deferred

2. List below any licensed supplier with whom you had an eligible purchaser agreement in the previous year, but with whom

you will no longer continue to defer payment. Suppliers listed here will be deleted from your deferred payment authorization

record. Complete additional entries on the reverse side of this form.

Supplier Name

FEIN or TR Number

Attach financial statements and mail to:

Michigan Department of Treasury

Special Taxes Division

P.O. Box 30474

Lansing, Michigan 48909-7974

Call (517) 636-4600 if you have any questions.

1

1 2

2