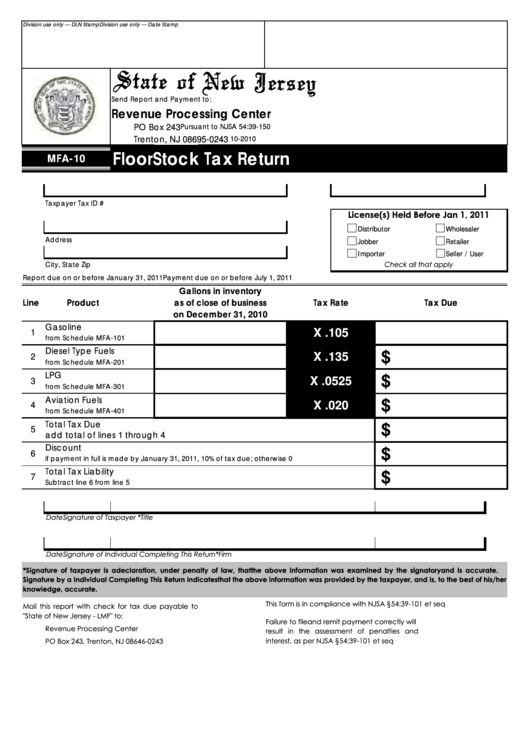

Division use only — DLN Stamp

Division use only — Date Stamp

Send Report and Payment to:

Revenue Processing Center

PO Box 243

Pursuant to NJSA 54:39-150

Trenton, NJ 08695-0243

10-2010

FloorStock Tax Return

MFA-10

Taxpayer

Tax ID #

License(s) Held Before Jan 1, 2011

Distributor

Wholesaler

Address

Jobber

Retailer

Importer

Seller / User

City, State Zip

Check all that apply

Report due on or before January 31, 2011

Payment due on or before July 1, 2011

Gallons in inventory

Line

Product

as of close of business

Tax Rate

Tax Due

on December 31, 2010

Gasoline

$

X .105

1

from Schedule MFA-101

Diesel Type Fuels

$

X .135

2

from Schedule MFA-201

LPG

$

X .0525

3

from Schedule MFA-301

Aviation Fuels

$

X .020

4

from Schedule MFA-401

Total Tax Due

$

5

add total of lines 1 through 4

Discount

$

6

if payment in full is made by January 31, 2011, 10% of tax due; otherwise 0

Total Tax Liability

$

7

Subtract line 6 from line 5

Date

Signature of Taxpayer *

Title

Date

Signature of Individual Completing This Return*

Firm

*Signature of taxpayer is a declaration, under penalty of law, that the above information was examined by the signatory and is accurate.

Signature by a Individual Completing This Return indicates that the above information was provided by the taxpayer, and is, to the best of his/her

knowledge, accurate.

This form is in compliance with NJSA §54:39-101 et seq

Mail this report with check for tax due payable to

"State of New Jersey - LMF" to:

Failure to file and remit payment correctly will

Revenue Processing Center

result in the assessment of penalties and

interest, as per NJSA §54:39-101 et seq

PO Box 243, Trenton, NJ 08646-0243

1

1 2

2 3

3 4

4 5

5