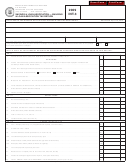

Form Cert-103 - Residential Condominium Association Page 2

ADVERTISEMENT

Name of Residential Condominium Assn. Address

CT Tax Registration Number

Federal Employer ID #

(If none, explain)

Name of Service Provider

Address

CT Tax Registration Number

Federal Employer ID #

(If none, explain)

General Description of services being rendered to residential condominium association by service provider

Period covered by this certificate:

(Calendar Year

)

Declaration by Condominium Association

As of the first day of the calendar year covered by this certificate, there were

units in this residential condominium

association of which

units were not occupied by their owners as dwellings. This information concerning occupancy

was obtained from unit owners.

In accordance with Conn. Agencies Regs. §12-407(2)(i)(I)-1(f)(4), because

% of the units were not owner-occupied,

the same percentage of any charges made to this condominium association by any service provider rendering services to

industrial, commercial, or income-producing real property, as defined in Conn. Agencies Regs. §12-407(2)(i)(I)-1(g), is subject

to sales and use taxes at the rate of 6% during the calendar year covered by this certificate.

Declaration: I declare under penalty of law that I have examined this return or document (including any accompanying

schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the

penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more

than five years, or both.

Name of Condominium Association

By:

Signature of Principal Officer

Title

Date

CERT-103 (Back)

(Rev. 01/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2