Form Cert-102 - Certified Rehabilitation Certificate For Certified Historic Structures

ADVERTISEMENT

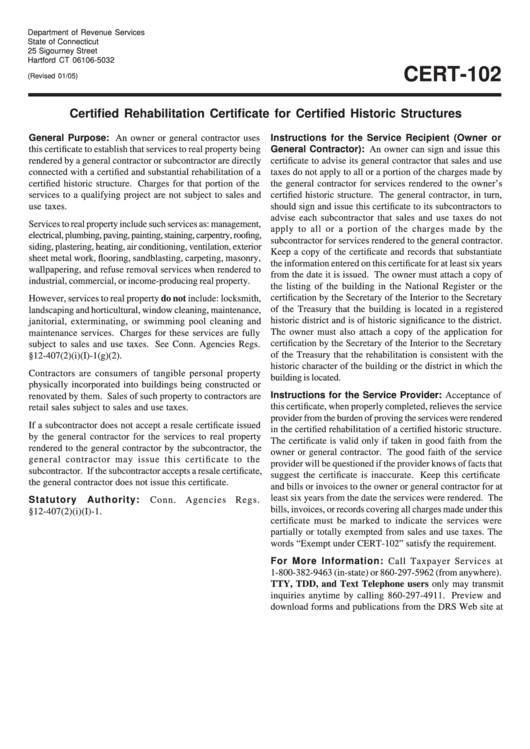

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-102

(Revised 01/05)

Certified Rehabilitation Certificate for Certified Historic Structures

General Purpose: An owner or general contractor uses

Instructions for the Service Recipient (Owner or

this certificate to establish that services to real property being

General Contractor): An owner can sign and issue this

rendered by a general contractor or subcontractor are directly

certificate to advise its general contractor that sales and use

connected with a certified and substantial rehabilitation of a

taxes do not apply to all or a portion of the charges made by

certified historic structure. Charges for that portion of the

the general contractor for services rendered to the owner’s

services to a qualifying project are not subject to sales and

certified historic structure. The general contractor, in turn,

use taxes.

should sign and issue this certificate to its subcontractors to

advise each subcontractor that sales and use taxes do not

Services to real property include such services as: management,

apply to all or a portion of the charges made by the

electrical, plumbing, paving, painting, staining, carpentry, roofing,

subcontractor for services rendered to the general contractor.

siding, plastering, heating, air conditioning, ventilation, exterior

Keep a copy of the certificate and records that substantiate

sheet metal work, flooring, sandblasting, carpeting, masonry,

the information entered on this certificate for at least six years

wallpapering, and refuse removal services when rendered to

from the date it is issued. The owner must attach a copy of

industrial, commercial, or income-producing real property.

the listing of the building in the National Register or the

certification by the Secretary of the Interior to the Secretary

However, services to real property do not include: locksmith,

of the Treasury that the building is located in a registered

landscaping and horticultural, window cleaning, maintenance,

historic district and is of historic significance to the district.

janitorial, exterminating, or swimming pool cleaning and

The owner must also attach a copy of the application for

maintenance services. Charges for these services are fully

certification by the Secretary of the Interior to the Secretary

subject to sales and use taxes. See Conn. Agencies Regs.

of the Treasury that the rehabilitation is consistent with the

§12-407(2)(i)(I)-1(g)(2).

historic character of the building or the district in which the

Contractors are consumers of tangible personal property

building is located.

physically incorporated into buildings being constructed or

Instructions for the Service Provider: Acceptance of

renovated by them. Sales of such property to contractors are

this certificate, when properly completed, relieves the service

retail sales subject to sales and use taxes.

provider from the burden of proving the services were rendered

If a subcontractor does not accept a resale certificate issued

in the certified rehabilitation of a certified historic structure.

by the general contractor for the services to real property

The certificate is valid only if taken in good faith from the

rendered to the general contractor by the subcontractor, the

owner or general contractor. The good faith of the service

general contractor may issue this certificate to the

provider will be questioned if the provider knows of facts that

subcontractor. If the subcontractor accepts a resale certificate,

suggest the certificate is inaccurate. Keep this certificate

the general contractor does not issue this certificate.

and bills or invoices to the owner or general contractor for at

least six years from the date the services were rendered. The

Statutory

Authority:

Conn. Agencies Regs.

bills, invoices, or records covering all charges made under this

§12-407(2)(i)(I)-1.

certificate must be marked to indicate the services were

partially or totally exempted from sales and use taxes. The

words “Exempt under CERT-102” satisfy the requirement.

For More Information: Call Taxpayer Services at

1-800-382-9463 (in-state) or 860-297-5962 (from anywhere).

TTY, TDD, and Text Telephone users only may transmit

inquiries anytime by calling 860-297-4911. Preview and

download forms and publications from the DRS Web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2