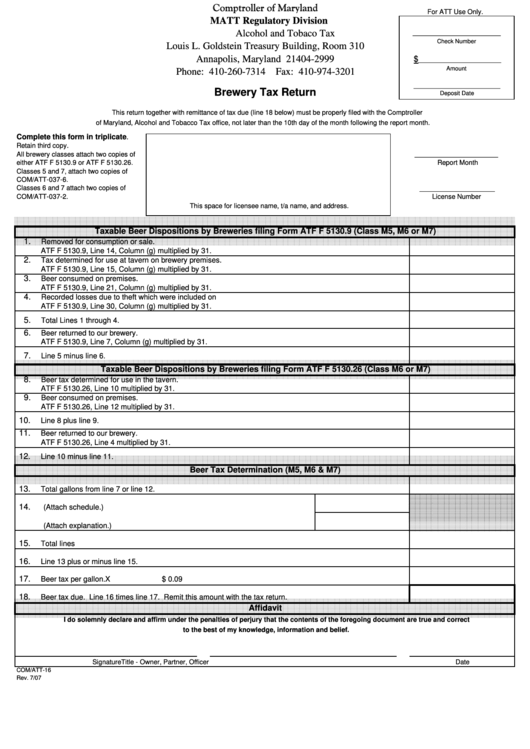

Comptroller of Maryland

For ATT Use Only.

MATT Regulatory Division

___________________

Alcohol and Tobaco Tax

Check Number

Louis L. Goldstein Treasury Building, Room 310

Annapolis, Maryland 21404-2999

$

______________________

Amount

Phone: 410-260-7314 Fax: 410-974-3201

_______________________

Brewery Tax Return

Deposit Date

This return together with remittance of tax due (line 18 below) must be properly filed with the Comptroller

of Maryland, Alcohol and Tobacco Tax office, not later than the 10th day of the month following the report month.

Complete this form in triplicate.

Retain third copy.

__________________

All brewery classes attach two copies of

either ATF F 5130.9 or ATF F 5130.26.

Report Month

Classes 5 and 7, attach two copies of

COM/ATT-037-6.

Classes 6 and 7 attach two copies of

____________________

COM/ATT-037-2.

License Number

This space for licensee name, t/a name, and address.

Taxable Beer Dispositions by Breweries filing Form ATF F 5130.9 (Class M5, M6 or M7)

1.

Removed for consumption or sale.

ATF F 5130.9, Line 14, Column (g) multiplied by 31.

2.

Tax determined for use at tavern on brewery premises.

ATF F 5130.9, Line 15, Column (g) multiplied by 31.

3.

Beer consumed on premises.

ATF F 5130.9, Line 21, Column (g) multiplied by 31.

4.

Recorded losses due to theft which were included on

ATF F 5130.9, Line 30, Column (g) multiplied by 31.

5.

Total Lines 1 through 4.

6.

Beer returned to our brewery.

ATF F 5130.9, Line 7, Column (g) multiplied by 31.

7.

Line 5 minus line 6.

Taxable Beer Dispositions by Breweries filing Form ATF F 5130.26 (Class M6 or M7)

8.

Beer tax determined for use in the tavern.

ATF F 5130.26, Line 10 multiplied by 31.

9.

Beer consumed on premises.

ATF F 5130.26, Line 12 multiplied by 31.

10.

Line 8 plus line 9.

11.

Beer returned to our brewery.

ATF F 5130.26, Line 4 multiplied by 31.

12.

Line 10 minus line 11.

Beer Tax Determination (M5, M6 & M7)

13.

Total gallons from line 7 or line 12.

14.

A.

Shipments out-of-State included in line 7 above. (Attach schedule.)

B.

Other Adjustments. (Attach explanation.)

15.

Total lines 14.A. and 14.B.

16.

Line 13 plus or minus line 15.

17.

Beer tax per gallon.

X

$ 0.09

18.

Beer tax due. Line 16 times line 17. Remit this amount with the tax return.

Affidavit

I do solemnly declare and affirm under the penalties of perjury that the contents of the foregoing document are true and correct

to the best of my knowledge, information and belief.

Signature

Title - Owner, Partner, Officer

Date

COM/ATT-16

Rev. 7/07

1

1 2

2