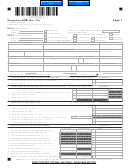

INVENTORY - TAX

FORM

MARYLAND

page 2

779

MOTOR FUEL

ADJUSTMENT

TAX

2013

Section 9-306(G) of the Tax-General Article requires all persons possessing tax-paid motor fuel for sale at the start of business on July

1, 2013 to compile and file an inventory of the motor fuel held at the close of business on the immediately preceding date and remit

any additional tax arising from an increase in the sales and use tax equivalent rate that is due on the motor fuel.

Business name _________________________________

Account # ________________________

Section B

Computation of Additional Sales and Use Tax Equivalent

(A)

(B)

(C)

Product

Gallons in

Tax Increase

Additional Tax Due

Inventory

Gasoline (other than aviation gasoline)

= $

1.

Tax paid Gasoline

X

$ 0.031

= $

2.

Tax paid Ethanol

X

$ 0.031

Special Fuel (other than clean-burning or turbine fuel)

= $

3.

Tax paid Diesel

X

$ 0.031

$

4.

Tax paid Kerosene

X

$ 0.031

=

Clean-burning Fuel (other than electricity)

= $

5.

Tax paid Propane

X

$ 0.031

= $

6.

Tax paid CNG

X

$ 0.031

= $

7.

Tax paid LNG

X

$ 0.031

$

8. Total sales and use tax equivalent

SIGNATURE AND VERIFICATION: I do solemnly declare, certify, and affirm under the penalties of perjury that the contents of

this document (including any accompanying schedules and statements) are true, correct and complete to the best of my knowledge,

information and belief.

Signature

Title

Date

Telephone Number

For more information:

Visit our Web site at or call Taxpayer Service at 410-260-7980 in Central Maryland or 1-800-638-2937

from elsewhere. Send faxes to 410-974-3608. Mail to: Comptroller of Maryland, Revenue Administration Division, PO Box 2191,

Annapolis, MD 21404-2191.

COM/RAD-779

(5/13)

1

1 2

2 3

3