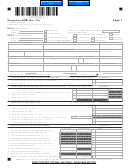

INVENTORY - TAX

MARYLAND

2013

FORM

779

MOTOR FUEL

BARCODE

ADJUSTMENT INSTRUCTIONS

TAX

General Instructions

Overview

Specific Instructions

The 2013 Session of the Maryland General Assembly enacted

Enter your business name and current address and the address

of your reporting location.

legislation raising the tax rate on motor fuel, effective July 1,

based upon the growth of the 12-month average Consumer Price

Use the spaces provided to enter your Federal Employer

Index (CPI) as of April 30 of each year. In years where there is

Identification Number (FEIN) or Social Security Number (SSN),

no growth in the CPI, there will be no increase in the motor fuel

Motor Fuel Account Number and, if available, Central Registration

tax rate. The fuels impacted by this rate change are:

Number.

• Gasoline other than aviation gasoline

Section A – Computation of Additional Motor Fuel Tax

• Special fuel other than clean-burning fuel or turbine fuel

Line

• Clean-burning fuel, except for electricity.

1-7. Enter the total gallons of product in your tax paid

Specifically, this rate change covers: gasoline, ethanol, diesel,

inventory as of close of business on June 30, 2013 in

kerosene, propane, compressed natural gas (CNG), and liquid

Column A. Multiply the gallons by $0.004 and enter the

natural gas (LNG).

result in Column C as Additional Tax Due.

In addition, the General Assembly enacted a new Sales and Use

8. Enter the total of lines 1 through 7 of Column C on line

Tax Equivalent tax based upon a percentage of the “average

8.

annual retail price” of regular unleaded motor fuel. As of June 1,

Stop here and complete Section B on page 2 of Form 779,

2013, the percentage rate used will be 1%.

then return to line 9 on page 1 of Form 779.

In order to properly report and remit the additional taxes due

9. Enter the total amount from Column C, line 8 of Section

on your motor fuel inventory, you will need to complete the

B on line 9.

enclosed Form 779, Maryland Inventory Tax Rate Adjustment –

10. Total Balance Due. Add the amounts from line 8 and

Motor Fuel Tax. Please read and complete the form fully before

line 9 of Section A.

transferring or selling any motor fuel on July 1, 2013. A physical

inventory is required of all tax-paid motor fuel held at the close

Section B – Computation of Additional Sales and Use Tax

of business on June 30, 2013.

Equivalent

Who must file this return?

Line

Any person possessing Maryland tax-paid motor fuel for sale as

1-7.

Enter the total gallons of product in your tax paid

of the start of business on July 1, 2013 must compile and file

inventory as of close of business on June 30, 2013 in

an inventory by submitting Form 779, and remit the tax due as

Column A. Multiply the gallons by $0.031 and enter

calculated on this form.

the result in Column C as Additional Tax Due.

When is this return due?

8. Enter the total of lines 1 through 7 of Column C on line

8. Also enter this amount on line 9 of Section A.

On or before July 31, 2013

Make check payable to “Comptroller of Maryland” and

Pursuant to Tax-General Article, Sections 9-305 and 9-306,

mail to:

this form and the additional tax due shall be properly filed and

received by the Revenue Administration Division no later than

COMPTROLLER OF MARYLAND

July 31, 2013.

REVENUE ADMINISTRATION DIVISION

PO BOX 2191

ANNAPOLIS MARYLAND 21404-2191

For more information:

Telephone: 410-260-7980, 1-800-638-2937

COM/RAD-779

(5/13)

1

1 2

2 3

3