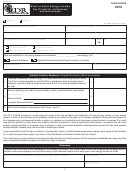

R-1086(1/13)

FILING PERIOD

2012

Wind or Solar Energy

Income Tax Credit

Worksheet

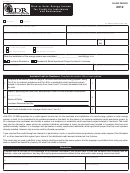

LSA–R.S. 47:6030 provides for a credit against income tax for the purchase and installation of a wind energy system or solar energy

system, or both, for an individual at his residence located in this state, for the owner of a Louisiana residential rental apartment project, or

for a taxpayer who purchases and installs a system in a residence or residential rental apartment project located in Louisiana. The credit

may also be claimed in cases where the resident individual purchases a newly constructed home that has such systems already installed,

or a taxpayer who purchases a newly constructed residential rental apartment project that has such systems already installed however,

only one tax credit is allowed per system. Please retain copies of this form and the purchase invoice(s) or other documents that support the

amounts entered on lines 1, 2, and 3 or the amounts entered on lines 7, 8, and 9 for review by the Department of Revenue upon request

for verification of solar and/or wind energy system costs related to this credit.

PLEASE PRINT OR TYPE.

Name of Taxpayer/Entity claiming credit

Social Security No. /Entity Louisiana Revenue Account No.

Physical address of location where system installed

City

ZIP

State

LA

Spouse’s Social Security No.

Name of Taxpayer’s spouse

(if joint return)

PART A

Available Credit for a Louisiana Residence - Complete this section if Box A, page 1 is checked.

1 Cost of new system equipment

1

2 Cost of new system Installation

2

3 Taxes associated with new system

3

4 Total

4

(Add Lines 1 through 3.)

5 Multiply Line 4 by 50% (.50)

5

6 Enter the smaller of Line 5 or $12,500

6

PART B

Available credit for Residential Rental Apartment Project located in Louisiana- Complete this section if Box B, page 1 is checked.

7 Cost of new system equipment

7

8 Cost of new system Installation

8

9 Taxes associated with new system

9

10 Total

10

(Add Lines 7 through 9.)

11 Multiply Line 10 by 50% (.50)

11

12 Enter the smaller of Line 11 or $12,500

12

Please complete a separate worksheet for each wind or solar energy system for which you are requesting credit. Attach each

worksheet to page 1.

2

1

1 2

2 3

3