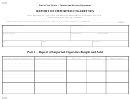

INSTRUCTIONS FOR

REPORTING SEVERANCE TAX - COAL

TYPE OF COAL

Total Severance Tax Due - (1) Total short tons multiplied by

(1) "Surface Coal" means all coal which is severed using

surface mining methods.

the tax rate. (2) Total Intergovernmental Tax Credit from ITC

worksheet.

(2) "Underground Coal" means all coal that is not surface

coal.

(3) "Intergovernmental Tax Credit" (ITC) for coal severed

Date Payment of Tax Due, Section 7-1-13 NMSA 1978 - The

severance tax is to be paid on or before the twenty-fifth day of the

and saved from tribal lands. Refer to Section 7-29C-2 NMSA

1978. Complete ITC worksheet.

month following the month in which the taxable event occurs.

Price Per Unit - Sales Price

Each form must be submitted in its entirety so that it can be

processed properly.

Quantity - Number of short tons (two-thousand pounds) of coal

severed and saved.

Copies of applicable tax acts may be obtained from the Taxation

and Revenue Department.

Gross Value - Price per unit multiplied by the quantity.

7-26-6.2 NMSA 1978

PENALTY AND INTEREST PROVISIONS OF THE TAX

The following coal is exempt from the surtax imposed on coal

ADMINISTRATION ACT

under the provisions of section 7-26-6 NMSA 1978.

"SECTION 7-1-67. INTEREST ON DEFICIENCIES.

Coal sold and delivered pursuant to coal sales contracts that

A.

If any tax imposed is not paid on or before the day on which

are entered into on or after July 1, 1990, under which deliveries

it becomes due, interest shall be paid to the state on such amount

start after July 1, 1990.

from the first day following the day on which the tax becomes due,

without regard to any extension of time or installment agreement,

Coal sold and delivered pursuant to a contract in effect on July

until it is paid.

1, 1990, that exceeds the average calendar year deliveries under

B.

Interest shall be due to the state based upon Section 7-1-67

the contract during production years 1987, 1988 and 1989 or the

NMSA 1978.

highest contract minimum during 1987, 1988 or 1989 whichever

is greater.

"SECTION 7-1-69. CIVIL PENALTY FOR FAILURE TO PAY TAX

OR FILE A RETURN.

If a contract existing on July 1, 1990 is renegotiated between a

A.

In the case of failure, due to negligence or disregard of rules

producer and a purchaser after May 20, 1992 and if that renegoti-

and regulations, but without intent to defraud, to pay when due

ated contract requires the purchaser to take annual coal deliveries

any amount of tax required to be paid or to file a return regardless

in excess of the greater of the average calendar year deliveries

of whether any tax is due, there shall be added to the amount

under the contract during production years 1987, 1988 and 1989

two percent per month or a fraction thereof from the date the tax

or the highest contract minimum during 1987, 1988 and 1989, the

was due or from the date the return was required to be filed, not

surtax imposed by Subsection B of Section 7-26-6 NMSA 1978

to exceed twenty percent thereof, or a minimum of five ($5.00),

shall not apply to such excess deliveries for the remaining term

whichever is greater, as penalty, but the five dollar ($5.00) minimum

of the renegotiated contract.

penalty shall not apply to taxes levied under the Income Tax Act

The taxpayer, prior to taking the exemption provided by this section,

[Chapter 7, Article 2 NMSA 1978] or the Corporate Income and

shall register any contract for the sale of coal that qualifies for the

Franchise Tax Act [Chapter 7, Article 2A NMSA 1978] or taxes

exemption from the surtax on forms provided by the Secretary.

administered by the department pursuant to Subsection B of

Section 7-1-2 NMSA 1978.

If your company qualifies for the lower tax rate imposed by the

above legislative change, under the first column of Form SEV-5

B.

In the case of failure, with intent to defraud the state, to pay

place the wording "Exempt Surface" or "Exempt Underground"

when due any amount of tax required to be paid, there shall be

on separate lines and calculate severance tax in accordance with

added to the amount fifty percent thereof or a minimum of twenty-

applicable tax rates.

five dollars ($25.00), whichever is greater, as penalty."

Tax Rate - upon each short ton of coal severed and saved there

Recovery of excess tax and corrections for erroneous reports are

shall be imposed on the severer a severance tax, plus surtax

prepared in identical manner. Amended reports must be prepared,

pursuant to Section 7-26-9 NMSA 1978 or severance tax only

consisting of a separate report for each reporting month. Only

pursuant to Section 7-26-6.2 NMSA 1978. The total severance

those entries being corrected are to be included and must show

surtax and severance tax if applicable on coal effective July 1,

these entries:

2013 is as follows:

(1) Original entry. Use parentheses to indicate a credit entry or

Surface

Underground

the word "none" if there was no original entry.

Base Tax Rate ....................... $

0.570

$

0.550

Surtax Rate............................ $

1.30

$

1.26

(2) Corrected entry. This entry will show the corrections being

Total Tax Rate ....................... $

1.87

$

1.81

made.

Surface

Underground

Exempt Coal .......................... $

0.570

$

0.550

See 7-26-6.2 NMSA 1978

1

1 2

2