Schedule M1nr - Minnesota Nonresidents/part-Year Residents - 2014

ADVERTISEMENT

201433

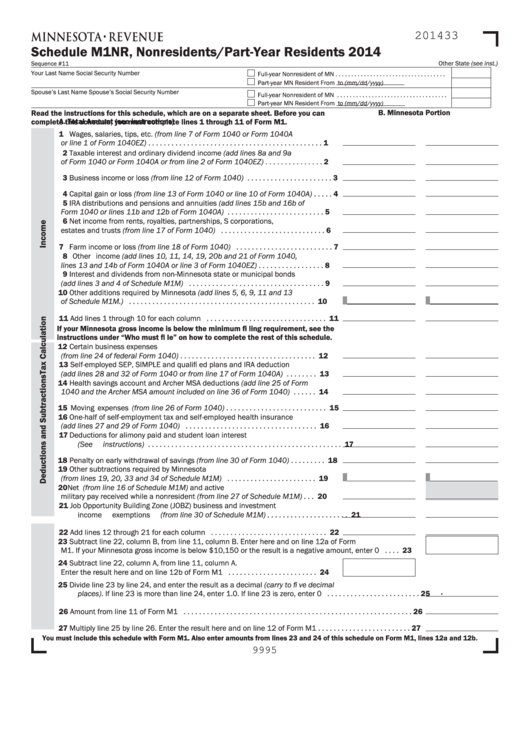

Schedule M1NR, Nonresidents/Part-Year Residents 2014

Sequence #11

Other State (see inst.)

Your Last Name

Social Security Number

Full-year Nonresident of MN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part-year MN Resident From

to

(mm/dd/yyyy)

Spouse’s Last Name

Spouse’s Social Security Number

Full-year Nonresident of MN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part-year MN Resident From

to

(mm/dd/yyyy)

B. Minnesota Portion

Read the instructions for this schedule, which are on a separate sheet. Before you can

A. Total Amount

(see instructions)

complete this schedule, you must complete lines 1 through 11 of Form M1.

1 Wages, salaries, tips, etc. (from line 7 of Form 1040 or Form 1040A

or line 1 of Form 1040EZ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Taxable interest and ordinary dividend income (add lines 8a and 9a

of Form 1040 or Form 1040A or from line 2 of Form 1040EZ) . . . . . . . . . . . . . . . 2

3 Business income or loss (from line 12 of Form 1040) . . . . . . . . . . . . . . . . . . . . . . 3

4 Capital gain or loss (from line 13 of Form 1040 or line 10 of Form 1040A) . . . . . 4

5 IRA distributions and pensions and annuities (add lines 15b and 16b of

Form 1040 or lines 11b and 12b of Form 1040A) . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Net income from rents, royalties, partnerships, S corporations,

estates and trusts (from line 17 of Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Farm income or loss (from line 18 of Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Other income (add lines 10, 11, 14, 19, 20b and 21 of Form 1040,

lines 13 and 14b of Form 1040A or line 3 of Form 1040EZ) . . . . . . . . . . . . . . . . . 8

9 Interest and dividends from non-Minnesota state or municipal bonds

(add lines 3 and 4 of Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Other additions required by Minnesota (add lines 5, 6, 9, 11 and 13

of Schedule M1M.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Add lines 1 through 10 for each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

If your Minnesota gross income is below the minimum fi ling requirement, see the

instructions under “Who must fi le” on how to complete the rest of this schedule.

12 Certain business expenses

(from line 24 of federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Self-employed SEP, SIMPLE and qualifi ed plans and IRA deduction

(add lines 28 and 32 of Form 1040 or from line 17 of Form 1040A) . . . . . . . . 13

14 Health savings account and Archer MSA deductions (add line 25 of Form

1040 and the Archer MSA amount included on line 36 of Form 1040) . . . . . . 14

15 Moving expenses (from line 26 of Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 One-half of self-employment tax and self-employed health insurance

(add lines 27 and 29 of Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Deductions for alimony paid and student loan interest

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Penalty on early withdrawal of savings (from line 30 of Form 1040) . . . . . . . . . 18

19 Other subtractions required by Minnesota

(from lines 19, 20, 33 and 34 of Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . 19

20 Net U.S. bond interest (from line 16 of Schedule M1M) and active

military pay received while a nonresident (from line 27 of Schedule M1M) . . . 20

21 Job Opportunity Building Zone (JOBZ) business and investment

income exemptions (from line 30 of Schedule M1M) . . . . . . . . . . . . . . . . . . . . . 21

22 Add lines 12 through 21 for each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Subtract line 22, column B, from line 11, column B. Enter here and on line 12a of Form

M1. If your Minnesota gross income is below $10,150 or the result is a negative amount, enter 0 . . . . 23

24 Subtract line 22, column A, from line 11, column A.

Enter the result here and on line 12b of Form M1 . . . . . . . . . . . . . . . . . . . . . . . 24

25 Divide line 23 by line 24, and enter the result as a decimal (carry to fi ve decimal

.

places). If line 23 is more than line 24, enter 1.0. If line 23 is zero, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Amount from line 11 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Multiply line 25 by line 26. Enter the result here and on line 12 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . 27

You must include this schedule with Form M1. Also enter amounts from lines 23 and 24 of this schedule on Form M1, lines 12a and 12b.

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3