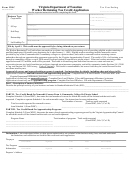

Form Wrc - Virginia Worker Retraining Tax Credit Application Page 2

ADVERTISEMENT

Schedule 1

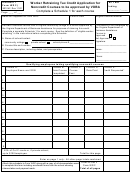

Worker Retraining Tax Credit Application for

Tax Year Ending

Form WRC

Noncredit Courses to be Approved by VDBA

,

Complete a Schedule 1 for each course.

Page

of

Name as it Appears on Form WRC

FEIN or SSN

List each noncredit course from a Virginia community college or a school approved by the

This section to be completed

Virginia Department of Business Assistance for purposes of claiming this credit. Complete

by the Virginia Department of

a separate Schedule 1 for each course. See the definition of "eligible worker retraining"

Business Assistance.

in the instructions before completing this Schedule.

Course Is:

A.

Name of School

Contact

Approved

Type (Check One)

Phone Number

Community College

Private School

Not Approved

B.

Course Title

Course Number

C. Course Description, Including Dates, and Prerequisites:

Signature

Name Printed

Phone

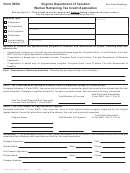

Qualifying Employees Taking Qualifying Noncredit Courses

A qualified employee cannot be a relative of any owner or the

employer claiming the credit and cannot own, directly or indirectly, more than five percent in value of the outstanding stock of a corporation

claiming the credit. See "Qualified Employee" section of instructions.

Column A

Column B

Column C

Column D

Column E

Employee Name and SSN

Date Course

Course Cost

Date Paid

Credit Requested*

Completed

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Total for This Page

Enter on Page 1 Only - All Other Page Totals Combined

Enter in Part II, Form WRC, Total of All Pages

* 30% of Col. C costs or, if private school, up to $100/employee.

Attach this schedule to Form WRC along with a copy of all documentation used to complete this form including enrollment forms from

the school showing classes taken and payment made.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5