Instructions For Alaska Cigarette Tax Stamp Application And Delivery Method

ADVERTISEMENT

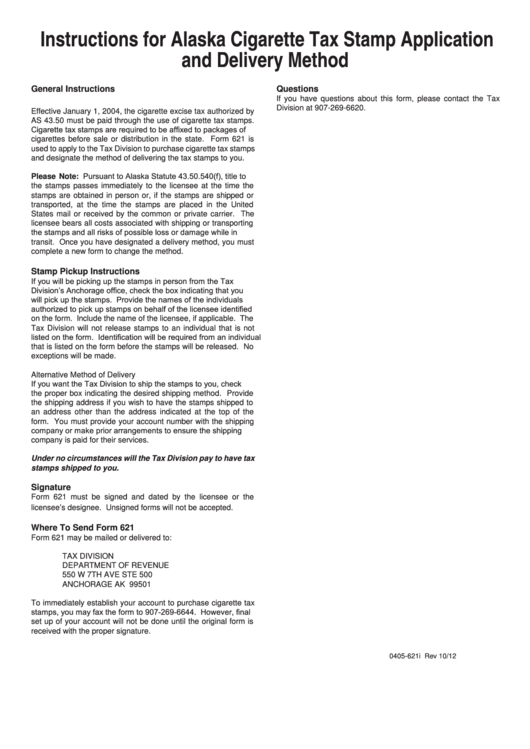

Instructions for Alaska Cigarette Tax Stamp Application

and Delivery Method

General Instructions

Questions

If you have questions about this form, please contact the Tax

Division at 907-269-6620.

Effective January 1, 2004, the cigarette excise tax authorized by

AS 43.50 must be paid through the use of cigarette tax stamps.

Cigarette tax stamps are required to be affixed to packages of

cigarettes before sale or distribution in the state. Form 621 is

used to apply to the Tax Division to purchase cigarette tax stamps

and designate the method of delivering the tax stamps to you.

Please Note: Pursuant to Alaska Statute 43.50.540(f), title to

the stamps passes immediately to the licensee at the time the

stamps are obtained in person or, if the stamps are shipped or

transported, at the time the stamps are placed in the United

States mail or received by the common or private carrier. The

licensee bears all costs associated with shipping or transporting

the stamps and all risks of possible loss or damage while in

transit. Once you have designated a delivery method, you must

complete a new form to change the method.

Stamp Pickup Instructions

If you will be picking up the stamps in person from the Tax

Division’s Anchorage office, check the box indicating that you

will pick up the stamps. Provide the names of the individuals

authorized to pick up stamps on behalf of the licensee identified

on the form. Include the name of the licensee, if applicable. The

Tax Division will not release stamps to an individual that is not

listed on the form. Identification will be required from an individual

that is listed on the form before the stamps will be released. No

exceptions will be made.

Alternative Method of Delivery

If you want the Tax Division to ship the stamps to you, check

the proper box indicating the desired shipping method. Provide

the shipping address if you wish to have the stamps shipped to

an address other than the address indicated at the top of the

form. You must provide your account number with the shipping

company or make prior arrangements to ensure the shipping

company is paid for their services.

Under no circumstances will the Tax Division pay to have tax

stamps shipped to you.

Signature

Form 621 must be signed and dated by the licensee or the

licensee’s designee. Unsigned forms will not be accepted.

Where To Send Form 621

Form 621 may be mailed or delivered to:

TAX DIVISION

DEPARTMENT OF REVENUE

550 W 7TH AVE STE 500

ANCHORAGE AK 99501

To immediately establish your account to purchase cigarette tax

stamps, you may fax the form to 907-269-6644. However, final

set up of your account will not be done until the original form is

received with the proper signature.

0405-621i Rev 10/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1