Instructions For Partial Property Tax Exemption Application For Clergy

ADVERTISEMENT

NYC DEPAR TMENT OF FINANCE

PAYMENT OPERATIONS

INSTRUCTIONS FOR

FINANCE

PAR TIAL PROPER TY TAX EXEMPTION APPLICATION FOR CLERGY

NEW YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

GENERAL INFORMATION AND REQUIREMENTS

1. Authorization for Exemption

3. Filing Date

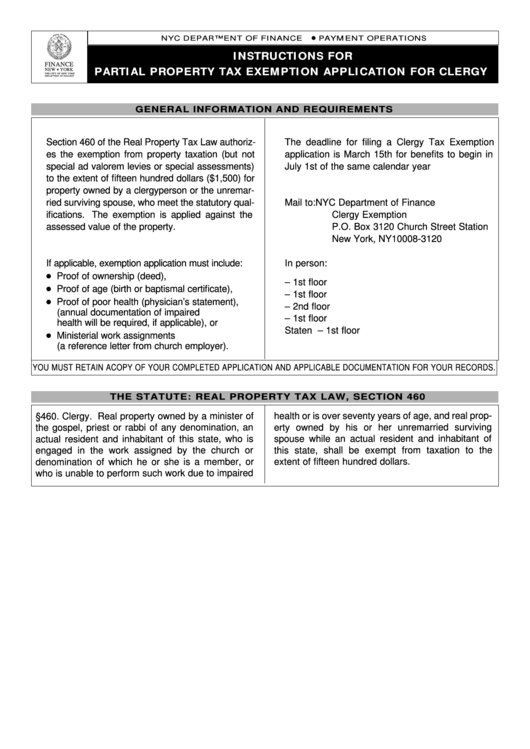

Section 460 of the Real Property Tax Law authoriz-

The deadline for filing a Clergy Tax Exemption

es the exemption from property taxation (but not

application is March 15th for benefits to begin in

special ad valorem levies or special assessments)

July 1st of the same calendar year

to the extent of fifteen hundred dollars ($1,500) for

property owned by a clergyperson or the unremar-

4. How to File

ried surviving spouse, who meet the statutory qual-

Mail to:

NYC Department of Finance

ifications. The exemption is applied against the

Clergy Exemption

assessed value of the property.

P.O. Box 3120 Church Street Station

New York, NY 10008-3120

2. Application for Exemption

If applicable, exemption application must include:

In person:

Proof of ownership (deed),

Bronx ...................1932 Arthur Avenue – 1st floor

Proof of age (birth or baptismal certificate),

Brooklyn............210 Joralemon Street – 1st floor

Proof of poor health (physician’s statement),

Manhattan...................66 John Street – 2nd floor

(annual documentation of impaired

Queens ...............144-06 94th Avenue – 1st floor

health will be required, if applicable), or

Staten Island.......350 St. Marks Place – 1st floor

Ministerial work assignments

(a reference letter from church employer).

YOU MUST RETAIN A COPY OF YOUR COMPLETED APPLICATION AND APPLICABLE DOCUMENTATION FOR YOUR RECORDS.

THE STATUTE: REAL PROPERTY TAX LAW, SECTION 460

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1