Instructions For Form Rct-111 - Pennsylvania Return

ADVERTISEMENT

Instructions for RCT-111 Return

RCT-111-I (11-11)

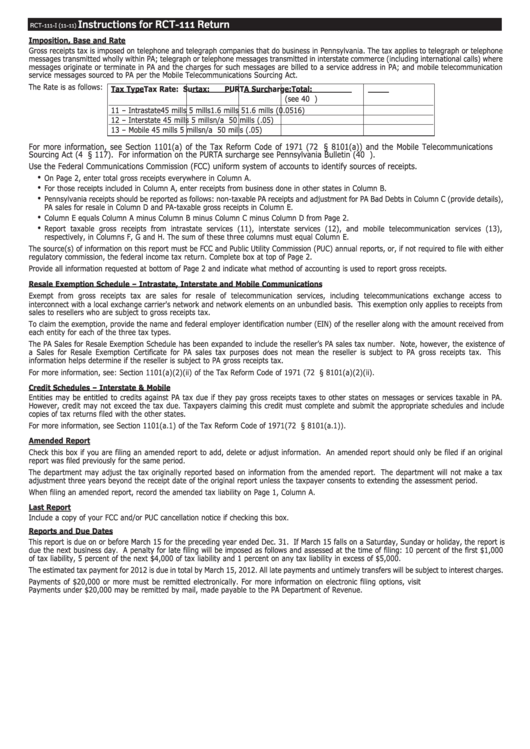

Imposition, Base and Rate

Gross receipts tax is imposed on telephone and telegraph companies that do business in Pennsylvania. The tax applies to telegraph or telephone

messages transmitted wholly within PA; telegraph or telephone messages transmitted in interstate commerce (including international calls) where

messages originate or terminate in PA and the charges for such messages are billed to a service address in PA; and mobile telecommunication

service messages sourced to PA per the Mobile Telecommunications Sourcing Act.

The Rate is as follows:

Tax Type

Tax Rate:

Surtax:

PURTA Surcharge:

Total:

(see 40 Pa.B. 7304)

11 – Intrastate

45 mills

5 mills

1.6 mills

51.6 mills (0.0516)

12 – Interstate

45 mills

5 mills

n/a

50 mills (.05)

13 – Mobile

45 mills

5 mills

n/a

50 mills (.05)

For more information, see Section 1101(a) of the Tax Reform Code of 1971 (72 P.S. § 8101(a)) and the Mobile Telecommunications

Sourcing Act (4 U.S.C. § 117). For information on the PURTA surcharge see Pennsylvania Bulletin (40 Pa.B. 7304).

Use the Federal Communications Commission (FCC) uniform system of accounts to identify sources of receipts.

•

On Page 2, enter total gross receipts everywhere in Column A.

•

For those receipts included in Column A, enter receipts from business done in other states in Column B.

•

Pennsylvania receipts should be reported as follows: non-taxable PA receipts and adjustment for PA Bad Debts in Column C (provide details),

PA sales for resale in Column D and PA-taxable gross receipts in Column E.

•

Column E equals Column A minus Column B minus Column C minus Column D from Page 2.

•

Report taxable gross receipts from intrastate services (11), interstate services (12), and mobile telecommunication services (13),

respectively, in Columns F, G and H. The sum of these three columns must equal Column E.

The source(s) of information on this report must be FCC and Public Utility Commission (PUC) annual reports, or, if not required to file with either

regulatory commission, the federal income tax return. Complete box at top of Page 2.

Provide all information requested at bottom of Page 2 and indicate what method of accounting is used to report gross receipts.

Resale Exemption Schedule – Intrastate, Interstate and Mobile Communications

Exempt from gross receipts tax are sales for resale of telecommunication services, including telecommunications exchange access to

interconnect with a local exchange carrier's network and network elements on an unbundled basis. This exemption only applies to receipts from

sales to resellers who are subject to gross receipts tax.

To claim the exemption, provide the name and federal employer identification number (EIN) of the reseller along with the amount received from

each entity for each of the three tax types.

The PA Sales for Resale Exemption Schedule has been expanded to include the reseller’s PA sales tax number. Note, however, the existence of

a Sales for Resale Exemption Certificate for PA sales tax purposes does not mean the reseller is subject to PA gross receipts tax. This

information helps determine if the reseller is subject to PA gross receipts tax.

For more information, see: Section 1101(a)(2)(ii) of the Tax Reform Code of 1971 (72 P.S. § 8101(a)(2)(ii).

Credit Schedules – Interstate & Mobile

Entities may be entitled to credits against PA tax due if they pay gross receipts taxes to other states on messages or services taxable in PA.

However, credit may not exceed the tax due. Taxpayers claiming this credit must complete and submit the appropriate schedules and include

copies of tax returns filed with the other states.

For more information, see Section 1101(a.1) of the Tax Reform Code of 1971(72 P.S. § 8101(a.1)).

Amended Report

Check this box if you are filing an amended report to add, delete or adjust information. An amended report should only be filed if an original

report was filed previously for the same period.

The department may adjust the tax originally reported based on information from the amended report. The department will not make a tax

adjustment three years beyond the receipt date of the original report unless the taxpayer consents to extending the assessment period.

When filing an amended report, record the amended tax liability on Page 1, Column A.

Last Report

Include a copy of your FCC and/or PUC cancellation notice if checking this box.

Reports and Due Dates

This report is due on or before March 15 for the preceding year ended Dec. 31. If March 15 falls on a Saturday, Sunday or holiday, the report is

due the next business day. A penalty for late filing will be imposed as follows and assessed at the time of filing: 10 percent of the first $1,000

of tax liability, 5 percent of the next $4,000 of tax liability and 1 percent on any tax liability in excess of $5,000.

The estimated tax payment for 2012 is due in total by March 15, 2012. All late payments and untimely transfers will be subject to interest charges.

Payments of $20,000 or more must be remitted electronically. For more information on electronic filing options, visit

Payments under $20,000 may be remitted by mail, made payable to the PA Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2