Instructions For 2014 Alaska Regional Seafood Development Tax Return

ADVERTISEMENT

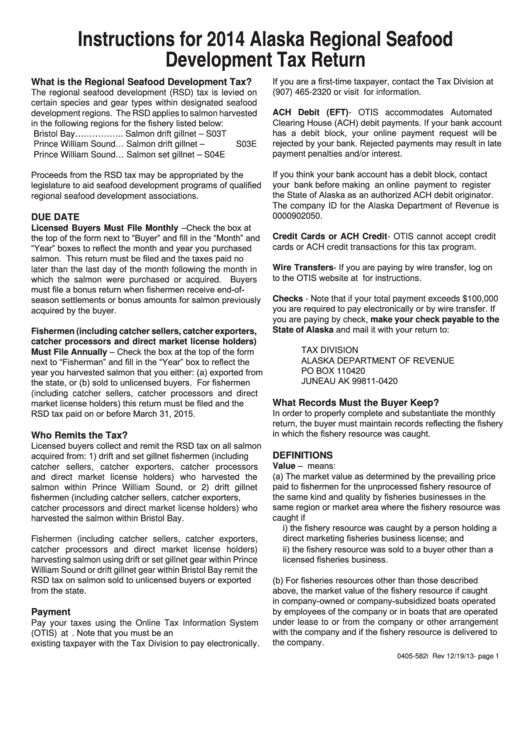

Instructions for 2014 Alaska Regional Seafood

Development Tax Return

If you are a first-time taxpayer, contact the Tax Division at

What is the Regional Seafood Development Tax?

(907) 465-2320 or visit for information.

The regional seafood development (RSD) tax is levied on

certain species and gear types within designated seafood

ACH Debit (EFT) - OTIS accommodates Automated

development regions. The RSD applies to salmon harvested

Clearing House (ACH) debit payments. If your bank account

in the following regions for the fishery listed below:

has a debit block, your online payment request will be

Bristol Bay…………….. Salmon drift gillnet – S03T

rejected by your bank. Rejected payments may result in late

Prince William Sound… Salmon drift gillnet – S03E

payment penalties and/or interest.

Prince William Sound… Salmon set gillnet – S04E

If you think your bank account has a debit block, contact

Proceeds from the RSD tax may be appropriated by the

your bank before making an online payment to register

legislature to aid seafood development programs of qualified

the State of Alaska as an authorized ACH debit originator.

regional seafood development associations.

The company ID for the Alaska Department of Revenue is

0000902050.

DUE DATE

Licensed Buyers Must File Monthly – Check the box at

the top of the form next to “Buyer” and fill in the “Month” and

Credit Cards or ACH Credit - OTIS cannot accept credit

“Year” boxes to reflect the month and year you purchased

cards or ACH credit transactions for this tax program.

salmon. This return must be filed and the taxes paid no

Wire Transfers - If you are paying by wire transfer, log on

later than the last day of the month following the month in

to the OTIS website at for instructions.

which the salmon were purchased or acquired. Buyers

must file a bonus return when fishermen receive end-of-

season settlements or bonus amounts for salmon previously

Checks - Note that if your total payment exceeds $100,000

you are required to pay electronically or by wire transfer. If

acquired by the buyer.

you are paying by check, make your check payable to the

State of Alaska and mail it with your return to:

Fishermen (including catcher sellers, catcher exporters,

catcher processors and direct market license holders)

Must File Annually – Check the box at the top of the form

TAX DIVISION

ALASKA DEPARTMENT OF REVENUE

next to “Fisherman” and fill in the “Year” box to reflect the

year you harvested salmon that you either: (a) exported from

PO BOX 110420

JUNEAU AK 99811-0420

the state, or (b) sold to unlicensed buyers. For fishermen

(including catcher sellers, catcher processors and direct

market license holders) this return must be filed and the

What Records Must the Buyer Keep?

In order to properly complete and substantiate the monthly

RSD tax paid on or before March 31, 2015.

return, the buyer must maintain records reflecting the fishery

in which the fishery resource was caught.

Who Remits the Tax?

Licensed buyers collect and remit the RSD tax on all salmon

acquired from: 1) drift and set gillnet fishermen (including

DEFINITIONS

Value – means:

catcher sellers, catcher exporters, catcher processors

(a) The market value as determined by the prevailing price

and direct market license holders) who harvested the

paid to fishermen for the unprocessed fishery resource of

salmon within Prince William Sound, or 2) drift gillnet

the same kind and quality by fisheries businesses in the

fishermen (including catcher sellers, catcher exporters,

same region or market area where the fishery resource was

catcher processors and direct market license holders) who

caught if

harvested the salmon within Bristol Bay.

i) the fishery resource was caught by a person holding a

direct marketing fisheries business license; and

Fishermen (including catcher sellers, catcher exporters,

ii) the fishery resource was sold to a buyer other than a

catcher processors and direct market license holders)

licensed fisheries business.

harvesting salmon using drift or set gillnet gear within Prince

William Sound or drift gillnet gear within Bristol Bay remit the

RSD tax on salmon sold to unlicensed buyers or exported

(b) For fisheries resources other than those described

above, the market value of the fishery resource if caught

from the state.

in company-owned or company-subsidized boats operated

by employees of the company or in boats that are operated

Payment

under lease to or from the company or other arrangement

Pay your taxes using the Online Tax Information System

with the company and if the fishery resource is delivered to

(OTIS) at . Note that you must be an

the company.

existing taxpayer with the Tax Division to pay electronically.

0405-582i Rev 12/19/13- page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2