Instructions For Form Ct-706, Connecticut Estate Tax Return

ADVERTISEMENT

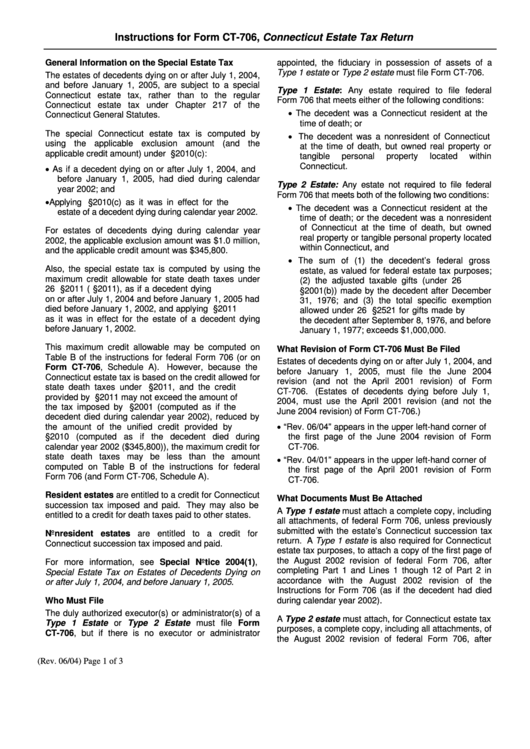

Instructions for Form CT-706, Connecticut Estate Tax Return

General Information on the Special Estate Tax

appointed, the fiduciary in possession of assets of a

Type 1 estate or Type 2 estate must file Form CT-706.

The estates of decedents dying on or after July 1, 2004,

and before January 1, 2005, are subject to a special

Type 1 Estate: Any estate required to file federal

Connecticut estate tax, rather than to the regular

Form 706 that meets either of the following conditions:

Connecticut estate tax under Chapter 217 of the

• The decedent was a Connecticut resident at the

Connecticut General Statutes.

time of death; or

The special Connecticut estate tax is computed by

• The decedent was a nonresident of Connecticut

using the applicable exclusion amount (and the

at the time of death, but owned real property or

applicable credit amount) under I.R.C. §2010(c):

tangible

personal

property

located

within

• As if a decedent dying on or after July 1, 2004, and

Connecticut.

before January 1, 2005, had died during calendar

Type 2 Estate: Any estate not required to file federal

year 2002; and

Form 706 that meets both of the following two conditions:

• Applying I.R.C. §2010(c) as it was in effect for the

• The decedent was a Connecticut resident at the

estate of a decedent dying during calendar year 2002.

time of death; or the decedent was a nonresident

of Connecticut at the time of death, but owned

For estates of decedents dying during calendar year

real property or tangible personal property located

2002, the applicable exclusion amount was $1.0 million,

within Connecticut, and

and the applicable credit amount was $345,800.

• The sum of (1) the decedent’s federal gross

Also, the special estate tax is computed by using the

estate, as valued for federal estate tax purposes;

maximum credit allowable for state death taxes under

(2) the adjusted taxable gifts (under 26 U.S.C.

26 U.S.C. §2011 (I.R.C. §2011), as if a decedent dying

§2001(b)) made by the decedent after December

on or after July 1, 2004 and before January 1, 2005 had

31, 1976; and (3) the total specific exemption

died before January 1, 2002, and applying I.R.C. §2011

allowed under 26 U.S.C. §2521 for gifts made by

as it was in effect for the estate of a decedent dying

the decedent after September 8, 1976, and before

before January 1, 2002.

January 1, 1977; exceeds $1,000,000.

This maximum credit allowable may be computed on

What Revision of Form CT-706 Must Be Filed

Table B of the instructions for federal Form 706 (or on

Estates of decedents dying on or after July 1, 2004, and

Form CT-706, Schedule A).

However, because the

before January 1, 2005, must file the June 2004

Connecticut estate tax is based on the credit allowed for

revision (and not the April 2001 revision) of Form

state death taxes under I.R.C. §2011, and the credit

CT-706.

(Estates of decedents dying before July 1,

provided by I.R.C. §2011 may not exceed the amount of

2004, must use the April 2001 revision (and not the

the tax imposed by I.R.C. §2001 (computed as if the

June 2004 revision) of Form CT-706.)

decedent died during calendar year 2002), reduced by

• “Rev. 06/04” appears in the upper left-hand corner of

the amount of the unified credit provided by I.R.C.

§2010 (computed as if the decedent died during

the first page of the June 2004 revision of Form

calendar year 2002 ($345,800)), the maximum credit for

CT-706.

state death taxes may be less than the amount

• “Rev. 04/01” appears in the upper left-hand corner of

computed on Table B of the instructions for federal

the first page of the April 2001 revision of Form

Form 706 (and Form CT-706, Schedule A).

CT-706.

Resident estates are entitled to a credit for Connecticut

What Documents Must Be Attached

succession tax imposed and paid. They may also be

A Type 1 estate must attach a complete copy, including

entitled to a credit for death taxes paid to other states.

all attachments, of federal Form 706, unless previously

submitted with the estate’s Connecticut succession tax

Nonresident estates are entitled to a credit for

return. A Type 1 estate is also required for Connecticut

Connecticut succession tax imposed and paid.

estate tax purposes, to attach a copy of the first page of

the August 2002 revision of federal Form 706, after

For more information, see Special Notice 2004(1),

completing Part 1 and Lines 1 though 12 of Part 2 in

Special Estate Tax on Estates of Decedents Dying on

accordance with the August 2002 revision of the

or after July 1, 2004, and before January 1, 2005.

Instructions for Form 706 (as if the decedent had died

during calendar year 2002).

Who Must File

The duly authorized executor(s) or administrator(s) of a

A Type 2 estate must attach, for Connecticut estate tax

Type 1 Estate or Type 2 Estate must file Form

purposes, a complete copy, including all attachments, of

CT-706, but if there is no executor or administrator

the August 2002 revision of federal Form 706, after

(Rev. 06/04)

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3