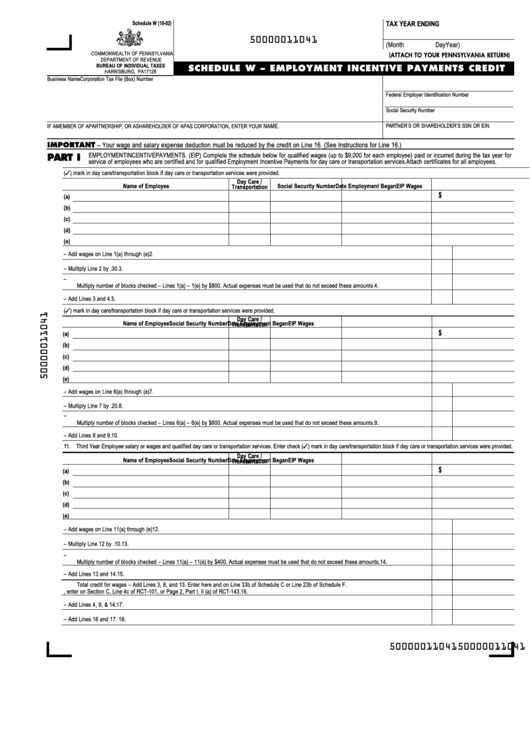

Schedule W - Employment Incentive Payments Credit

ADVERTISEMENT

Schedule W (10-02)

TAX YEAR ENDING

50000011041

(Month

Day

Year)

COMMONWEALTH OF PENNSYLVANIA

(ATTACH TO YOUR PENNSYLVANIA RETURN)

DEPARTMENT OF REVENUE

BUREAU OF INDIVIDUAL TAXES

SCHEDULE W – EMPLOYMENT INCENTIVE PAYMENTS CREDIT

HARRISBURG, PA 17128

Business Name

Corporation Tax File (Box) Number

Federal Employer Identification Number

Social Security Number

NAME.

PARTNER’S OR SHAREHOLDER’S SSN OR EIN.

IF A MEMBER OF A PARTNERSHIP, OR A SHAREHOLDER OF A PA S CORPORATION, ENTER YOUR

IMPORTANT – Your wage and salary expense deduction must be reduced by the credit on Line 16. (See Instructions for Line 16.)

EMPLOYMENT INCENTIVE PAYMENTS. (EIP) Complete the schedule below for qualified wages (up to $9,000 for each employee) paid or incurred during the tax year for

PART I

service of employees who are certified and for qualified Employment Incentive Payments for day care or transportation services. Attach certificates for all employees.

1.

First-year employee salary or wages and qualified day care or transportation services. Enter check ( ) mark in day care/transportation block if day care or transportation services were provided.

Day Care /

Name of Employee

Social Security Number

Date Employment Began

EIP Wages

Transportation

$

(a)

(b)

(c)

(d)

(e)

2.

Total qualified first year wages paid or incurred – Add wages on Line 1(a) through (e)

2.

3.

Total Employment Incentive Payment Credit for Wages – Multiply Line 2 by .30.

3.

4.

Total Employment Incentive Payment Credit for Day Care Services and Transportation Services –

Multiply number of blocks checked – Lines 1(a) – 1(e) by $800. Actual expenses must be used that do not exceed these amounts.

4.

5.

Total First Year Employment Incentive Credit – Add Lines 3 and 4.

5.

6.

Second Year Employee salary or wages and qualified day care or transportation services. Enter check ( ) mark in day care/transportation block if day care or transportation services were provided.

Day Care /

Name of Employee

Social Security Number

Date Employment Began

EIP Wages

Transportation

$

(a)

(b)

(c)

(d)

(e)

7.

Total qualified second year wages paid or incurred – Add wages on Line 6(a) through (e)

7.

8.

Total Employment Incentive Payment Credit for Wages – Multiply LIne 7 by .20.

8.

9.

Total Employment Incentive Payment Credit for Day Care Services and Transportation Services –

Multiply number of blocks checked – Lines 6(a) – 6(e) by $600. Actual expenses must be used that do not exceed these amounts.

9.

10. Total Second Year Employment Incentive Credit – Add Lines 8 and 9.

10.

11.

Third Year Employee salary or wages and qualified day care or transportation services. Enter check ( ) mark in day care/transportation block if day care or transportation services were provided.

Day Care /

Name of Employee

Social Security Number

Date Employment Began

EIP Wages

Transportation

$

(a)

(b)

(c)

(d)

(e)

12. Total qualified third year wages paid or incurred – Add wages on Line 11(a) through (e)

12.

13. Total Employment Incentive Payment Credit for Wages – Multiply Line 12 by .10.

13.

14. Total Employment Incentive Payment Credit for Day Care Services and Transportation Services –

Multiply number of blocks checked – Lines 11(a) – 11(e) by $400. Actual expenses must be used that do not exceed these amounts.

14.

15. Total Third year Employment Incentive Credit – Add Lines 13 and 14.

15.

Total credit for wages – Add Lines 3, 8, and 13. Enter here and on Line 33b of Schedule C or Line 23b of Schedule F.

16. If corporation, enter on Section C, Line 4c of RCT-101, or Page 2, Part I, II (a) of RCT-143.

16.

17. Total credit for day care or transportation services – Add Lines 4, 9, & 14.

17.

18. Total current Employment Incentive Payment Credit – Add Lines 16 and 17.

18.

50000011041

50000011041

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4