Schedule W - Employment Incentive Payments Credit Page 2

ADVERTISEMENT

50000012042

OFFICIAL USE ONLY

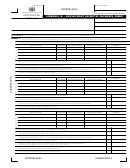

PART II

Calculation of Credit

19a. Total Current Employment Incentive Payment Credit -

Enter amount from Line 18

19a.

19b. Amount of Carryover Credit Available From Previous Year’s Return

19b.

19. Total available Employment Incentive Payment Credit for present tax year. Total 19A, 19B and K1 amount.

19.

20.

Tax Liability

I.

If filing Individual Income Tax Return, enter amount from PA-40, Line 12.

II. If filing Fiduciary Income Tax Return, enter amount from PA-41, Line 10.

III. If corporation filing form RCT-101, enter amount from page 3, section C, Line 14.

IV. If other organization, enter appropriate tax liability before application of credit on tax return.

20.

21. Other Credits against tax liability

I.

If filing Individual or Fiduciary Income Tax return, enter amounts

(if any) from PA-40 or PA-41;

(a) Line 22, PA-40 or Line 12, PA-41– taxes paid by PA residents to other states 21a.

(b) Line 21, PA-40 – TAX BACK/Tax Forgiveness claimed on Schedule SP

21b.

(c) Total – If none, enter “0”.

21c.

or.) II. If corporation, enter amount of Neighborhood Assistance Credit. If none, enter “0”.

21.

22. Tax Liability to which credit may be applied (Subtract Line 21 from Line 20.) If none, enter “0”.

22.

23. Maximum allowable credit (Multiply Line 22 by .90.)

23.

24. Total credit to be allowed for present tax year. Enter lesser of Line 19 or 23.

24.

Amount of Employment Incentive Payment Credit available for use in subsequent years (Subtract

25. Line 24 from Line 19.) If none, enter “0”.

25.

GENERAL INFORMATION

Under the provisions of the Welfare Reform Act of April 8, 1982, a tax credit was created for persons and corporations that employ certain wel-

fare recipients. This credit was expanded in 2000 to include vocational rehabilitation employees. An additional tax credit for employers that pro-

vide day care service for the children of welfare recipients or vocational rehabilitation employees is also available. Effective for the 2000 tax year,

this tax credit was expanded to include transportation services provided for certified employees by employers.

I. WHO IS ELIGIBLE FOR THE CREDIT

for the first year of employment, $600 for the second year, and $400 for the

third year.

Any employers who are individuals, partnerships, proprietorships, PA S

corporations, estates, or trusts may apply the credit against their Personal

Income Tax liability or their estate's or trust's income tax liability on their

III. QUALIFICATION FOR CREDIT

Pennsylvania Personal Income Tax Return (PA-40/PA-41).

The employer is not entitled to claim the credit until employment has con-

tinued for at least one full year unless the employee (a) voluntarily leaves

With respect to employers who are corporations, banks and financial

the employer, (b) becomes disabled or, (c) is terminated for cause.

institutions, title insurance and trust companies, savings and loan com-

panies, or insurance companies, the tax credit may be applied against

the corporate net income, bank shares, mutual thrift net earnings, or

IV. CONDITIONAL EIP CREDIT

gross premiums tax liability on their appropriate Pennsylvania Corporate

An employer is not entitled to the EIP Credit until the employee has com-

Tax Report.

pleted one (1) full employment year. An employer may claim a condition-

al EIP Credit on the annual tax return or tax report for that portion of the

II.

AMOUNT OF CREDIT

tax year which the employee worked.

The credit for each certified individual hired shall be equal to, but may not

If, at the time of filing the tax return or tax report, the employee is

exceed, 30 percent of the first $9,000 of qualified first year wages for the

removed from employment, for reasons other than specified in III above,

first year of employment, 20 percent of the first $9,000 of qualified wages

the EIP Credit cannot be claimed. If, after filing the tax return or tax

for the second year of employment, and 10 percent of the first $9,000 of

report, the employee is removed from employment before completing the

qualified wages for the third year of employment.

full employment year, for reasons other than specified in III above, the

employer's tax return or tax report will be adjusted. When this occurs, the

If the employer provides or pays for approved day care services for a child or

children of a certified employee or transportation services for a certified

employer may be liable for tax, with appropriate penalties and additions,

employee, the employer shall be eligible for an additional credit up to $800

from the due date of the tax return.

50000012042

50000012042

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4