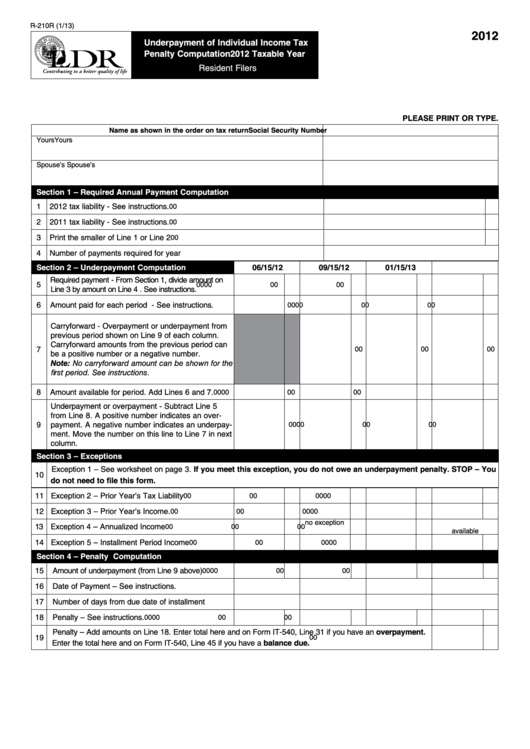

R-210R (1/13)

2012

Underpayment of Individual Income Tax

Penalty Computation 2012 Taxable Year

Resident Filers

PLEASE PRINT OR TYPE.

Name as shown in the order on tax return

Social Security Number

Yours

Yours

Spouse’s

Spouse’s

Section 1 – Required Annual Payment Computation

1

2012 tax liability - See instructions.

00

2

2011 tax liability - See instructions.

00

3

Print the smaller of Line 1 or Line 2

00

4

Number of payments required for year

Section 2 – Underpayment Computation

04/15/12

06/15/12

09/15/12

01/15/13

Required payment - From Section 1, divide amount on

5

00

00

00

00

Line 3 by amount on Line 4 . See instructions.

6

Amount paid for each period - See instructions.

00

00

00

00

Carryforward - Overpayment or underpayment from

previous period shown on Line 9 of each column.

Carryforward amounts from the previous period can

7

00

00

00

be a positive number or a negative number.

Note: No carryforward amount can be shown for the

first period. See instructions.

8

Amount available for period. Add Lines 6 and 7.

00

00

00

00

Underpayment or overpayment - Subtract Line 5

from Line 8. A positive number indicates an over-

9

payment. A negative number indicates an underpay-

00

00

00

00

ment. Move the number on this line to Line 7 in next

column.

Section 3 – Exceptions

Exception 1 – See worksheet on page 3. If you meet this exception, you do not owe an underpayment penalty. STOP – You

10

do not need to file this form.

11 Exception 2 – Prior Year’s Tax Liability

00

00

00

00

12 Exception 3 – Prior Year’s Income.

00

00

00

00

no exception

13 Exception 4 – Annualized Income

00

00

00

available

14 Exception 5 – Installment Period Income

00

00

00

00

Section 4 – Penalty Computation

15

Amount of underpayment (from Line 9 above)

00

00

00

00

16

Date of Payment – See instructions.

17

Number of days from due date of installment

18

Penalty – See instructions.

00

00

00

00

Penalty – Add amounts on Line 18. Enter total here and on Form IT-540, Line 31 if you have an overpayment.

19

00

Enter the total here and on Form IT-540, Line 45 if you have a balance due.

1

1