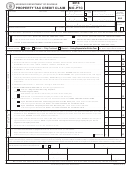

Instructions for Form PR-141 Renter Rebate Claim

The Renter Rebate Program refunds eligible renters the portion of

Line 1 VT School District Code Go to the table on page 14 and

rent paid that exceeds an established percentage of household income .

select the three-digit school district code for the town where you

lived on December 31, 2013 .

Do NOT file a renter rebate if you rent a lot for your mobile home.

See instructions for HS-122.

Line 2 Legal Residence

Enter your legal residence as of

December 31, 2013 . Your legal residence is where you lived and

TENANTS ARE TO RECEIVE THE LANDLORD’S

may be different from your mailing address .

CERTIFICATE BY

Location of Rental Property Enter the physical location as of

Date

If Landlord has

12/31/2013 . DO NOT enter a post office box, “same”, “see

January 31, 2014 or before . . . . . . . . . . . .2 or more residential units

above,” or the town name .

Upon tenant request . . . . . . . . . . . . . . . . . . . . . . . . 1 residential unit

Eligibility Questions ALL questions must be answered or the claim

cannot be processed . Check the appropriate “Yes” or “No” box

Submit a completed Landlord’s Certificate, LC-142, for each rental

for Q1, Q2 and Q3 to determine your eligibility .

unit you occupied in calendar year 2013 .

MISSING INFORMATION OR INCOMPLETE FILING:

Rebate Calculation

Claims that are incomplete or are missing information are not

Only the rent paid during the calendar year is eligible for a renter

considered filed . The information must be provided by the

rebate .

October 15 filing deadline . Information received after that time

Line 3 Allocable Rent

Enter amount from the Landlord’s

cannot be accepted .

Certificate, LC-142, Line 16 . Allocable rent is based on rent

INJURED SPOUSE CLAIMS: To make an “injured spouse”

paid in a calendar year . MORE THAN ONE LANDLORD’S

claim, send the following information prior to filing your claim:

CERTIFICATE: Add Line 16 from each certificate and enter

(1) the request letter; and,

amount on this line . File all LC-142s with your claim . If

the landlord certificate has indicated on Line 6 items that are

(2) copy of Federal Form 8379 (if you filed one with the

included in rent and Line 11 on the landlord certificate is left

IRS) .

blank, the allowable rent will automatically be reduced by 50%

Mail To: VT Department of Taxes, ATTN: Injured Spouse Unit,

except rental in nursing homes, community care, assisted living,

PO Box 1645, Montpelier VT 05601-1645 .

and like facilities and boarding houses will be reduced by 75% .

The Department will notify you if the renter rebate is taken to

Line 4 Home Use If you use more than 25% of your rental unit’s

pay a bill . You have 30 days from the date on the notice to

floor space for business purposes, the allowable rent amount

submit the injured spouse claim to the Department .

is adjusted . The percentage of business use is generally the

same percentage used on your Federal Form 8829 . To calculate

ELIGIBILITY FOR RENTER REBATE: You must meet ALL of

business use, divide the square feet used for business by the total

the following eligibility requirements:

square feet in the rental unit . Example: You use an 11’ x 12’

• You were domiciled in VT for the entire calendar year

room for an office and inventory storage . Your rental unit is

2013 and,

484 square feet (including the business use) . Your business use

• You were not claimed in 2013 as a dependent of another

2

is 11 x 12 = 132 f

/ 484 = .27 or 27% business use . Entry on

taxpayer; and,

Line 4 for home use is 73 .00 (100% - 27%) .

• Your household income in 2013 did not exceed $47,000;

If the rental unit is used solely as your home, or business use is

and,

25% or less, enter 100% on Line 4 .

• You are the only person in the household making a renter

Line 5 Allowable Rent for Rebate Claim Multiply Line 3 by

rebate claim; and,

Line 4 .

• You rented in VT for all 12 months in 2013. See page 44

Line 6 Household Income Enter the amount from Schedule HI-144,

for the one exception .

Line y .

DECEASED RENTER: A claim cannot be filed on behalf of a

Line 7 Maximum Percentage of Income for Rent Use the chart to

deceased person . The right to file a renter rebate claim is personal

find your household income range and applicable percentage .

to the claimant and does not survive the claimant’s death .

Enter that percentage here .

NURSING OR RESIDENTIAL CARE HOME: The Renter

Line 8 Maximum Allowable Rent for Household Income Multiply

Rebate Claim is for the room occupancy charge only . Services

Line 6 by Line 7 . If Line 8 is more than or the same as Line 5,

such as heat, electricity, personal services, medical services, etc .,

you are not eligible .

must be deducted . Generally, the room charge is 25% of the

Line 9 Renter Rebate Amount Subtract Line 8 from Line 5 . This is

total charges to the person . For a percentage greater than 25%,

your 2013 renter rebate . If you are filing the renter rebate claim

a breakout of costs must be provided . Payments by Medicaid on

with your 2013 VT income tax return, also enter this amount

behalf of the Claimant to the nursing home are not part of rent

on Form IN-111, Line 31d . You may be issued one check

paid .

combining any income refund and rebate due you .

NOTE: A person residing in a nursing or residential care home that

NOTE: A Renter Rebate cannot exceed $3,000.

owns a homestead with a sibling or spouse can claim a renter

Signature Sign the claim .

rebate if the sibling or spouse does not make a property tax

adjustment claim .

Date Write the date on which the claim form was signed .

LINE-BY-LINE INSTRUCTIONS

Disclosure Authorization If you wish to give the Department

authorization to discuss your 2013 Renter Rebate Claim with

Complete Schedule HI-144 FIRST. If Line y is more than $47,000,

your tax preparer, check this box and include the preparer’s

you are ineligible .

name .

Supporting Documents Required: Schedule HI-144 and LC-142

Preparer If you are a paid preparer, you must also sign the claim,

enter your Social Security number or PTIN and, if employed by

Claimant’s Date of Birth Enter your date of birth

a business, the EIN of the business .

Claimant Information Enter your name, your spouse/civil union

If someone other than the filer(s) prepared the return without

partner name, mailing address and Social Security number(s) .

charging a fee, then that preparer’s signature is optional .

The rebate is issued to the name(s) and address on record . The

claimant is the leaseholder or the person responsible for the rent .

Only one claim per household is allowed .

26

Form PR-141

1

1 2

2 3

3 4

4