IT-CA 2008

Page 2

Print

Clear

B. INSTRUCTIONS

Part I

In order to complete Part 1 (CERTIFICATION AND INSTRUCTIONS) and the remainder of IT-CA 2008, the taxpayer must be familiar

with the law and regulations. Applicable law includes O.C.G.A. 48-7-40, O.C.G.A. 48-7-40.1, O.C.G.A. 48-7-40.23 and O.C.G.A.

36-62-5.1. Other law may be applicable depending on taxpayer circumstances. Applicable regulations include regulations issued

by the Georgia Department of Community Affairs (Rules 110-9-1-.01, 110-9-1-.02, and 110-9-1-.03) and those issued by the

Georgia Department of Revenue (Rule 560-7-8-.36).

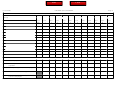

Part II

Provide the information requested on the number of full-time jobs at the end of each month based on the taxpayer’s fiscal year.

(See regulations issued by the Georgia Department of Community Affairs for further information.)

Part III-V

Year 1 is the tax year of new jobs increase and the Prior Year is the preceding tax year. (See Rule 110-9-1-.01 of the Job Tax

Credit Program Regulations for the definition of these and other terms.)

Line 1

Total employees is the total of full-time employees subject to Georgia income tax withholding at the end of each

applicable monthly reporting period.

Line 2

Number of months of operation in each tax year (usually 12).

Line 3

Monthly average of full-time employees (line 1 divided by line 2). Round to the nearest whole number.

Line 4

Previous year's monthly average from line 3.

Line 5

Average increase (decrease) in full-time employees (line 3 less line 4).

Job Tax Credit Program

Line 6-11

Enter the appropriate average increase if maintained.

See Rule 110-9-1-.03 of the

Regulations for detailed instructions.

Line 12

Number of jobs eligible for credit equals the total of lines 6 - 11.

Line 13

Multiply line 12 by $3,500, $2,500, $1,250 or $750 depending on whether the business created jobs in a tier 1

county or eligible census tract area ($3,500 credit), tier 2 county ($2,500 credit), tier 3 county ($1,250 credit), or

tier 4 county ($750 credit) and add to this figure the amount of any unused credits from previous years. (The

unused credit amounts may not include credits designated to be used against withholding or credits that have

expired.) If the new full-time jobs were located in an eligible census tract area, information must be attached

showing that at least 30% of the qualifying jobs are held by residents of a less developed census tract area or a

tier 1 county. (Contact the Job Tax Credit Program Coordinator at the Department of Community Affairs on the

type of information required.) Note that if jobs have been created within a joint development authority area, the

amount of credit is increased by $500 per job. Also note that if jobs on Line 12 were created in different years,

credit amounts per job may vary depending on the credit amounts applicable in the years the jobs were created.

See the Job Tax Credit Regulations for further details.

Line 14

Enter the amount of tax liability for this tax year before any Job Tax Credit.

Line 15

Enter 50% of line 14 (for tier 3 or 4) or 100% of line 14 (for tier 1 or 2) of line 14.

Line 16

Enter the lesser of line 15 or line 13. (Amount of Job Tax Credit for current year.)

Line 17

Enter the amount of unused tax credits that may be carried forward: Line 16 minus line 13. Unused tax credits

may be carried forward for 10 years from the close of the tax year in which the qualified jobs were established.

Use the FIFO method to determine which tax credits expire at what time. See the Job Tax Credit Regulations for

further details.

The tax credit is calculated on the basis of the average number of new full-time jobs created by county or census

NOTE:

tract area by taxpayer. Before any credit can be received, a business must create at least an average of 2 (less

developed census tract area), 5 (tier 1 county or less developed census tract area), 10 (tier 2 county), 15 (tier 3

county) or 25 (tier 4 county) new full-time jobs in an eligible county or census tract area. The creation of 2, 5, 10, 15,

or 25 jobs in two or more counties or census tract areas does not meet job threshold requirements.

1

1 2

2 3

3 4

4