Form Spf-100tc - Summary Of Business Franchise Tax - 2013

ADVERTISEMENT

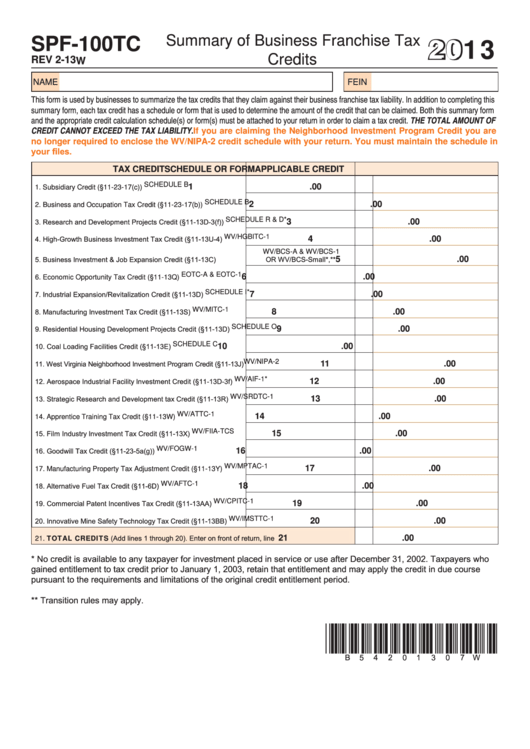

2013

Summary of Business Franchise Tax

SPF-100TC

Credits

REV 2-13

W

NAME

FEIN

This form is used by businesses to summarize the tax credits that they claim against their business franchise tax liability. In addition to completing this

summary form, each tax credit has a schedule or form that is used to determine the amount of the credit that can be claimed. Both this summary form

and the appropriate credit calculation schedule(s) or form(s) must be attached to your return in order to claim a tax credit. THE TOTAL AMOUNT OF

CREDIT CANNOT EXCEED THE TAX LIABILITY.

If you are claiming the Neighborhood Investment Program Credit you are

no longer required to enclose the WV/NIPA-2 credit schedule with your return. You must maintain the schedule in

your files.

TAX CREDIT

SCHEDULE OR FORM

APPLICABLE CREDIT

SCHEDULE B

1

.00

1. Subsidiary Credit (§11-23-17(c)).....................................................

SCHEDULE B

2

.00

2. Business and Occupation Tax Credit (§11-23-17(b))......................

SCHEDULE R & D*

3. Research and Development Projects Credit (§11-13D-3(f))...........

3

.00

WV/HGBITC-1

4. High-Growth Business Investment Tax Credit (§11-13U-4)............

4

.00

WV/BCS-A & WV/BCS-1

5. Business Investment & Job Expansion Credit (§11-13C)...............

OR WV/BCS-Small*,**

5

.00

EOTC-A & EOTC-1

6

.00

6. Economic Opportunity Tax Credit (§11-13Q)..................................

SCHEDULE I*

7. Industrial Expansion/Revitalization Credit (§11-13D).....................

7

.00

WV/MITC-1

8. Manufacturing Investment Tax Credit (§11-13S).............................

8

.00

SCHEDULE O

9. Residential Housing Development Projects Credit (§11-13D)........

9

.00

SCHEDULE C

10. Coal Loading Facilities Credit (§11-13E)......................................

10

.00

WV/NIPA-2

11. West Virginia Neighborhood Investment Program Credit (§11-13J)

11

.00

WV/AIF-1*

12. Aerospace Industrial Facility Investment Credit (§11-13D-3f)......

12

.00

WV/SRDTC-1

13. Strategic Research and Development tax Credit (§11-13R)........

13

.00

WV/ATTC-1

14

.00

14. Apprentice Training Tax Credit (§11-13W)....................................

WV/FIIA-TCS

15. Film Industry Investment Tax Credit (§11-13X).............................

15

.00

WV/FOGW-1

16. Goodwill Tax Credit (§11-23-5a(g))...............................................

16

.00

WV/MPTAC-1

17

.00

17. Manufacturing Property Tax Adjustment Credit (§11-13Y)............

WV/AFTC-1

18. Alternative Fuel Tax Credit (§11-6D).............................................

18

.00

WV/CPITC-1

19. Commercial Patent Incentives Tax Credit (§11-13AA)..................

19

.00

WV/IMSTTC-1

20. Innovative Mine Safety Technology Tax Credit (§11-13BB)..........

20

.00

21. TOTAL CREDITS (Add lines 1 through 20). Enter on front of return, line 7......................................

21

.00

* No credit is available to any taxpayer for investment placed in service or use after December 31, 2002. Taxpayers who

gained entitlement to tax credit prior to January 1, 2003, retain that entitlement and may apply the credit in due course

pursuant to the requirements and limitations of the original credit entitlement period.

** Transition rules may apply.

*b54201307W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1