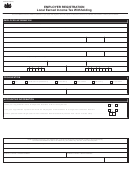

Instructions for Payor

Section 3402(d) of the Internal Revenue Code provides that you can be relieved of payment of

income tax not withheld from a payee, provided you can show that the payee has reported the

payments and paid the tax. You should obtain a separate Form 4669, Statement of Payments

Received, from each payee for each year relief is requested. However, you are still liable for any

penalty or addition to the tax that applies to your failure to deduct and withhold. After you get all

Statements of Payments Received, please summarize them by year on the front of this form,

and send them with this form to the Internal Revenue Service Center at the address for your location.

Exception for exempt organizations and government entities- If you are filing Form 4670 for

an exempt organization or government entity (Federal, state, local, or Indian tribal government),

use the following address regardless of your location: Ogden, UT 84201-0046

Connecticut, Delaware, District of Columbia,

Cincinnati, OH 45999-0005

Illinois, Indiana, Kentucky, Maine, Maryland,

Massachusetts, Michigan, New Hampshire,

New Jersey, New York, North Carolina,

Ohio, Pennsylvania, Rhode Island,

South Carolina, Vermont, Virginia,

West Virginia, Wisconsin

Alabama, Alaska, Arizona, Arkansas, California,

Odgen, UT 84201-0005

Colorado, Florida, Georgia, Hawaii, Idaho, Iowa,

Kansas, Louisiana, Minnesota, Mississippi,

Missouri, Montana, Nebraska, Nevada, New Mexico,

North Dakota, Oklahoma, Oregon, South Dakota,

Tennessee, Texas, Utah, Washington, Wyoming

If you have no legal residence or principal place of business in any state, file with the Internal

Revenue Service Center, Philadelphia, PA 19255-0005.

Important: It is to your advantage to file this form and the required attachments at the earliest

possible date, to avoid collection action.

Form 4670 (Rev. 1-2004)

Catalog No. 23290O

1

1 2

2