Form Wv/mitc-1 - Credit For Manufacturing Investment Page 5

ADVERTISEMENT

PROPERTY PURCHASED FOR MULTIPLE BUSINESS USES

I

n the case of property purchased and used partly as a component of a new, expanded, or revitalized industrial facility and used partly

in some other business or activity not eligible for credit (for example, in retail selling), the cost of the property is apportioned between

the qualified and nonqualified activities, and the amount apportioned to the new or expanded or revitalized industrial facility is

considered qualified investment. The use of the property in the qualified activity and nonqualified activity, respectively, must be

thoroughly supported and explained by documents submitted with the application, and the amount of credit arising from investment

in the multiple use property must be based on cost allocated to the qualified activity.

ELIGIBLE INVESTMENT

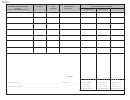

To determine the amount of eligible investment for the manufacturing investment tax credit, the cost of each asset purchased is

multiplied by the applicable percentage shown below according to the useful life of the property.

If useful life is: The applicable percentage is:

4 years or more but less than 6 years 33 1/3%

6 years or more but less than 8 years 66 2/3%

8 years or more 100 %

EXAMPLE

On February 10, 2003, a Taxpayer purchases a machine at a cost of $25,000 for use in a new, expanded, or

ongoing portion of its industrial facility, which has a useful life of 6 years.

The eligible investment is equal to $16,666.67.

Eligible investment is calculated by multiplying the cost of the equipment, $25,000, times the applicable

percentage according to the useful life, 66 2/3%, to arrive at $16,666.67.

($25,000 x 66 2/3% = $16,666.67)

The credit attributable to the asset is equal to 5% of the eligible investment or $833.33, (5% x $16,666.67 = $833.33).

This credit must be claimed over a period of 10 years at a rate of 10% ($83.33) per year.

CREDIT RECAPTURE

Credit attributable to property that ceases to be used in West Virginia prior to the end of the categorized useful life of the property must

be recalculated for all tax years for which the credit based on that asset was applied, according to actual useful life. For example,

Company A invests $10 million in equipment with an assumed useful life of 8 years in 2003.

($10M x 100% applicable percentage) x 5% = $500,000

The credit for Company A is calculated to equal $500,000 or $50,000 per year for 10 years.

÷

($500,000)

10 years = $50,000 credit available each year.

Company A moves this equipment to New York in 2008. Therefore, the equipment’s actual useful life in West Virginia is reduced to

only 5 years. The corresponding credit is reduced according to the above formula from $500,000 to $166,667 or $16,667 per year

for 10 years.

(($10M x 331/3% applicable percentage) = $3,333,333.33) x 5% = $166,666.67)

÷

$166,666.67

10 years = $16, 666.67 credit available each year

A reconciliation statement for the 2003 through 2008 period reflecting an over utilization of credit must then be submitted with

payment of any additional tax, interest and penalties owed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7