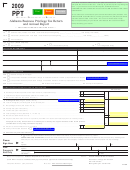

FORM

BUSINESS PRIVILEGE

Alabama Department of Revenue

110002PP

TAXABLE/FORM YEAR

PPT

Alabama Business Privilege Tax Pass-Through Entity

2011

Privilege Tax Computation Schedule

PAGE 2

1a. FEIN

1b. LEGAL NAME OF BUSINESS ENTITY

1c. DETERMINATION PERIOD END DATE (BALANCE SHEET DATE)

(MM/DD/YYYY)

PART A – NET WORTH COMPUTATION

I. S-Corporations

1 Issued capital stock and additional paid in capital (without reduction for treasury stock)

•

but not less than zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

•

2 Retained earnings, but not less than zero, including dividends payable. . . . . . . . . . . . . . . .

2

•

3 Gross amount of related party debt exceeding the sums of line 1 and 2. . . . . . . . . . . . . . . .

3

•

4 All payments for compensation, distributions, or similar amounts in excess of $500,000.. . .

4

•

5 Total net worth (add lines 1-4). Go to Part B, line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

II. Limited Liability Entities (LLE's)

•

6 Sum of the partners’/members’ capital accounts, but not less than zero . . . . . . . . . . . . . . .

6

7 All compensation, distributions, or similar amounts paid to a partner/member in

•

excess of $500,000.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

•

8 Gross amount of related party debt exceeding the amount on line 6.. . . . . . . . . . . . . . . . . .

8

•

9 Total net worth (add lines 6, 7 and 8). Go to Part B, line 1. . . . . . . . . . . . . . . . . . . . . . . . . .

9

III. Disregarded Entities

10 (Reserved for future use.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 If a disregarded entity has as its single member a taxpayer that is subject to the privilege tax, then the disregarded entity pays the minimum tax. (Go to Part B, line 19.)

Single Member Name: •

FEIN: •

12 Assets minus liabilities for all disregarded entities that have as a single member an entity

•

that is not subject to the privilege tax.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

•

13 Gross amount of related party debt exceeding the amount on line 12 . . . . . . . . . . . . . . . . .

13

14 For disregarded entities, all compensation, distributions,

•

or similar amounts paid to a member in excess of $500,000. . . . . . . . . . . . . . . . . . . . . . . .

14

•

15 Total net worth (sum of lines 12, 13 and 14). Go to Part B, line 1.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

PART B – PRIVILEGE TAX EXCLUSIONS AND DEDUCTIONS

Exclusions (Attach supporting documentation) (See Instructions)

•

1 Total net worth from Part A – line 5, 9, or 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 (Reserved for future use.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

•

3 Unamortized portion of goodwill resulting from a direct purchase. . . . . . . . . . . . . . . . . . . . .

3

•

4 Unamortized balance of properly elected post-retirement benefits pursuant to FASB 106. . .

4

•

5 Total exclusions (sum of lines 2-4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

•

6 Net worth subject to apportionment (line 1 less line 5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

•

.

%

7 Apportionment factor (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

•

8 Total Alabama net worth (multiply line 6 by line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Deductions (Attach supporting documentation) (See Instructions)

9 Net investment in bonds and securities issued by the State of Alabama or

•

political subdivision thereof, when issued prior to January 1, 2000. . . . . . . . . . . . . . . . . . . .

9

•

10 Net investment in all air, ground, or water pollution control devices in Alabama. . . . . . . . . .

10

11 Reserves for reclamation, storage, disposal, decontamination, or retirement

•

associated with a plant, facility, mine or site in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

•

12 Book value of amount invested in qualifying low income housing projects (see instructions)

12

•

13 30 percent of federal taxable income apportioned to Alabama, but not less than zero . . . . .

13

•

14 Total deductions (add lines 9-13). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

•

15 Taxable Alabama net worth (line 8 less line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

•

16a Federal Taxable Income Apportioned to AL . . .

16a

•

.

16b Tax rate (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16b

•

17 Gross privilege tax calculated (multiply line 15 by line 16b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

•

18 Alabama enterprise zone credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Privilege Tax Due (line 17 less line 18) (minimum $100, for maximum see instructions)

Go to Page 1 of PPT

•

Enter also on Form PPT, page 1, line 9, Privilege Tax Due (must be paid by the original due date of the return) . . . . . . . . . . . . . . . .

19

S-corporations must complete and attach an Alabama Schedule AL-CAR, and enter $10 for the corporate annual report fee on line 6, page 1.

Other (noncorporate) pass-through entities are not required to file an Alabama Schedule AL-CAR or pay the corporate annual report fee.

ADOR

1

1 2

2 3

3 4

4