Reset Form

Print Form

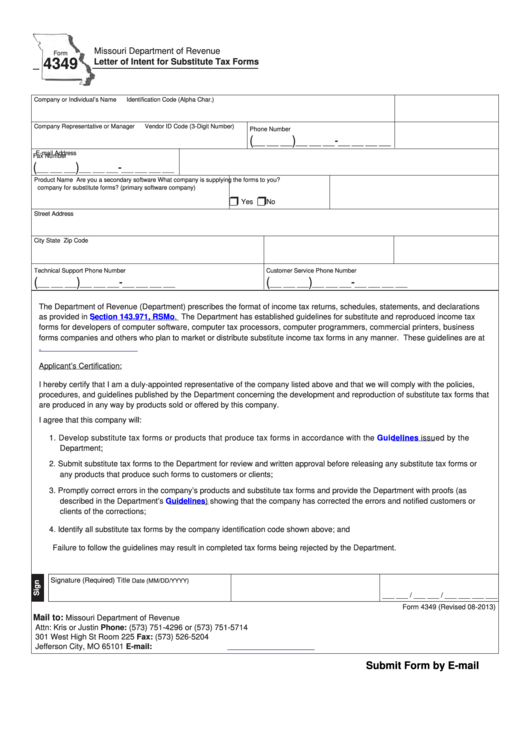

Missouri Department of Revenue

Form

4349

Letter of Intent for Substitute Tax Forms

Company or Individual’s Name

Identification Code (Alpha Char.)

Company Representative or Manager

Vendor ID Code (3-Digit Number)

Phone Number

(

)

-

___ ___ ___

___ ___ ___

___ ___ ___ ___

E-mail Address

Fax Number

(

)

-

___ ___ ___

___ ___ ___

___ ___ ___ ___

Product Name

Are you a secondary software

What company is supplying the forms to you?

company for substitute forms?

(primary software company)

r

r

Yes

No

Street Address

City

State

Zip Code

Technical Support Phone Number

Customer Service Phone Number

(

)

-

(

)

-

___ ___ ___

___ ___ ___

___ ___ ___ ___

___ ___ ___

___ ___ ___

___ ___ ___ ___

The Department of Revenue (Department) prescribes the format of income tax returns, schedules, statements, and declarations

as provided in

Section 143.971,

RSMo. The Department has established guidelines for substitute and reproduced income tax

forms for developers of computer software, computer tax processors, computer programmers, commercial printers, business

forms companies and others who plan to market or distribute substitute income tax forms in any manner. These guidelines are at

Applicant’s Certification:

I hereby certify that I am a duly-appointed representative of the company listed above and that we will comply with the policies,

procedures, and guidelines published by the Department concerning the development and reproduction of substitute tax forms that

are produced in any way by products sold or offered by this company.

I agree that this company will:

1. Develop substitute tax forms or products that produce tax forms in accordance with the

Guidelines

issued by the

Department;

2. Submit substitute tax forms to the Department for review and written approval before releasing any substitute tax forms or

any products that produce such forms to customers or clients;

3. Promptly correct errors in the company’s products and substitute tax forms and provide the Department with proofs (as

described in the Department’s Guidelines) showing that the company has corrected the errors and notified customers or

clients of the corrections;

4. Identify all substitute tax forms by the company identification code shown above; and

Failure to follow the guidelines may result in completed tax forms being rejected by the Department.

Signature (Required)

Title

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Form 4349 (Revised 08-2013)

Mail to:

Missouri Department of Revenue

Attn: Kris or Justin

Phone: (573) 751-4296 or (573) 751-5714

301 West High St Room 225

Fax: (573) 526-5204

Jefferson City, MO 65101

E-mail:

piccforms@dor.mo.gov

Submit Form by E-mail

1

1